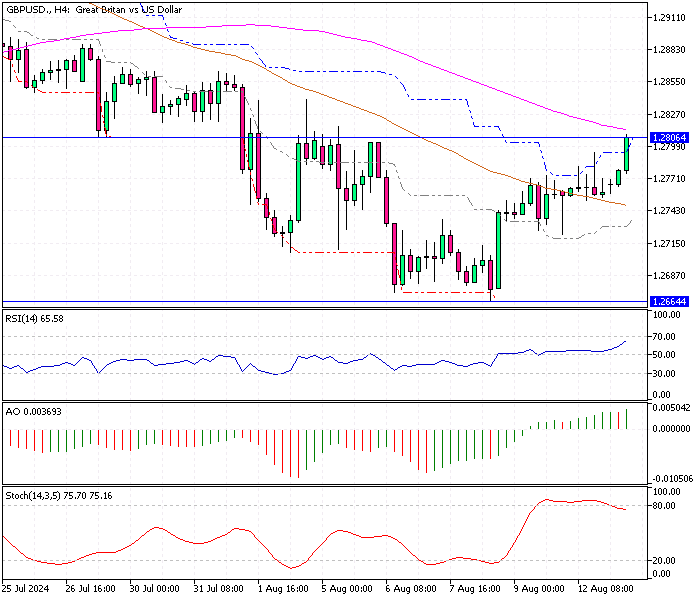

GBPUSD Fundamental Analysis – 13-August-2024

The British pound recently climbed above $1.28 (GBP/USD) following remarks from Bank of England (BoE) policymaker Catherine Mann, signaling potential tightening ahead. Although inflation has eased somewhat, Mann urged caution, emphasizing that inflationary pressures are still a significant concern.

Persistent Inflation and Rising Costs in Goods and Services

Despite the recent decrease in inflation, Mann pointed out that the prices of goods and services continue to rise steadily. This ongoing increase suggests that the fight against inflation is far from over.

She warned that the pressure on wages might persist and last for several years, making it difficult to achieve the BoE’s goal of bringing inflation down to the 2% target.

The Challenge of High Services Inflation

One of the significant challenges highlighted by Mann is the persistent high inflation in the services sector, which remains above 5% annually. This level of inflation complicates the Bank of England’s efforts to stabilize the overall inflation rate.

Mann’s comments suggest that the BoE might need to remain vigilant and possibly take further action to keep inflation under control.

- Also read: EURUSD Fundamental Analysis – 13-August-2024

Wages and the “Upward Ratchet” Effect

Mann also discussed the risk of an “upward ratchet” in wages. This term refers to a situation where pay increases at lower income levels trigger demands for higher wages at higher levels, potentially leading to a cycle of wage and price increases.

This wage growth dynamic could make it harder to tame inflation, as rising wages might continue to fuel higher prices.

Upcoming Economic Data and Investor Expectations

Investors are now closely watching for upcoming economic data, particularly the inflation figures due on Wednesday. The data is expected to show an increase in the UK Consumer Price Index (CPI) to 2.3% from 2%. This will be the first inflation report following the Bank of England’s recent decision to cut interest rates by 25 basis points, marking the first rate cut this year.

Additionally, labor market data expected tomorrow might reveal a slowdown in wage growth, which could have significant implications for the BoE’s future policy decisions.

Comments are closed.