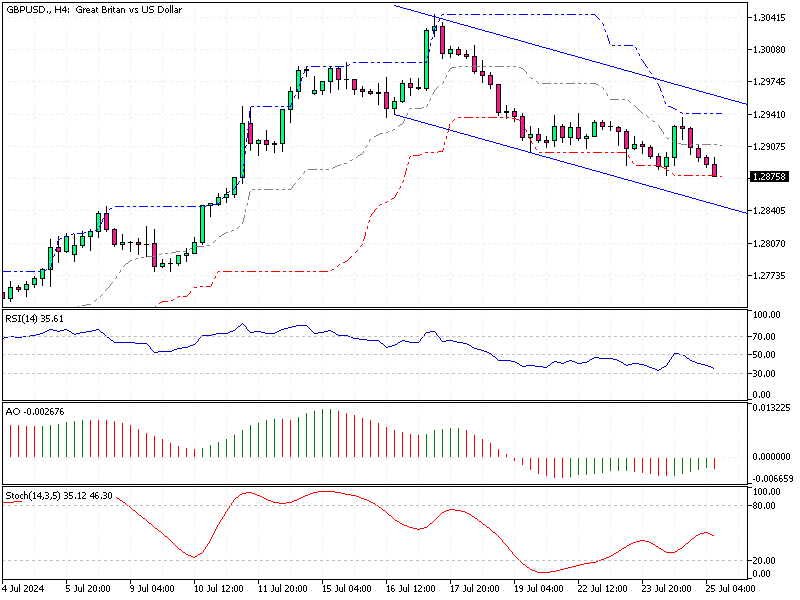

GBPUSD Fundamental Analysis – 25-July-2024

The British pound has surged above $1.290 following positive economic data from the UK. This rise is attributed to robust private sector activity in July, as the Purchasing Managers’ Index (PMI) reported.

PMI Data Shows Positive Growth

The PMI data revealed a slight acceleration in services activity and the strongest manufacturing output since February 2022. This indicates a healthy expansion in the UK’s private sector, meeting market expectations and boosting business confidence.

- Read also: EUR/USD Fundamental Analysis – 25-July-2024

Impact of Labour’s Election Victory

The Labour Party’s recent landslide election victory has further fueled this positive sentiment. Companies are reporting increased confidence, which has led to higher hiring rates and a surge in new orders, contributing to the economic uptick.

Bank of England’s Rate Cut Bets Unchanged

Despite these positive developments, there has been no significant change in expectations regarding the Bank of England’s interest rate cuts. The probability of an August rate cut remains at around 40%, indicating that cautious optimism prevails while the economy is improving.

GBPUSD Fundamental Analysis – 25-July-2024

Looking ahead, the combination of robust private sector growth and increased business confidence suggests a stable economic outlook for the UK.

However, market participants should remain vigilant, as the unchanged rate cut probabilities indicate that the Bank of England is still weighing its options in response to evolving economic conditions.

Comments are closed.