GBPUSD Fundamental Analysis – 27-August-2024

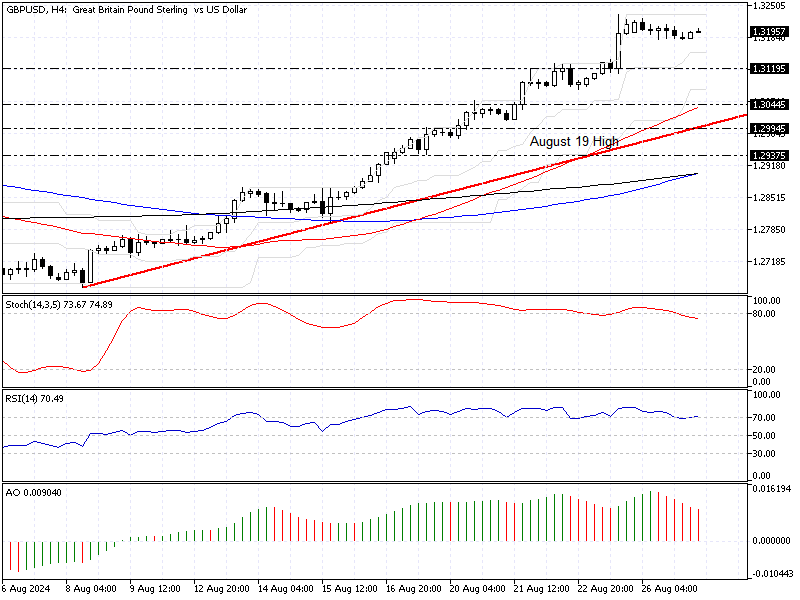

The British pound recently climbed above $1.322 (GBP/USD), reaching its highest value since March 2022. This surge followed key discussions at the Jackson Hole Economic Symposium, where influential figures from the Bank of England and the US Federal Reserve shared important economic insights.

Bank of England’s Stance on Future Interest Rate Cuts

Bank of England Governor Andrew Bailey hinted that more interest rate reductions could be coming soon. This would offer relief to mortgage holders facing high repayment costs. Bailey emphasized that inflation in the UK is decreasing quicker than expected.

However, he warned that the Bank must remain cautious and ensure inflation stays controlled before making significant changes. This caution follows the recent rate cut from 5.25% to 5% to balance economic growth and inflation.

US Federal Reserve’s Position on Economic Adjustments

During the same event, US Federal Reserve Chairman Jerome Powell expressed that the Fed is also considering interest rate cuts in the near future. He pointed to declining inflation rates and a rise in unemployment as indicators that the Fed might need to adjust its current policy.

Powell’s remarks suggest that the US and UK central banks are moving towards a more cautious approach, carefully monitoring economic trends before taking further action.

What Does This Mean for the Economy?

The discussions at Jackson Hole highlight how closely central banks watch inflation trends and economic indicators. As inflation eases, the Bank of England and the US Federal Reserve are exploring options to support economic stability while controlling future inflation.

If the rate cuts go forward, this could lead to lower borrowing costs for consumers, especially those with loans or mortgages. However, these decisions depend on how the global economy continues to evolve.

Summary: Caution in Uncertain Times

Overall, the message from the Jackson Hole Symposium is one of careful consideration. While inflation concerns are easing, the UK and US prioritize stability before making any bold moves. This cautious approach shows that while rate cuts may be on the horizon, they will be implemented gradually to avoid any negative economic impact.

Comments are closed.