GBPUSD Fundamental Analysis – 4-June-2024

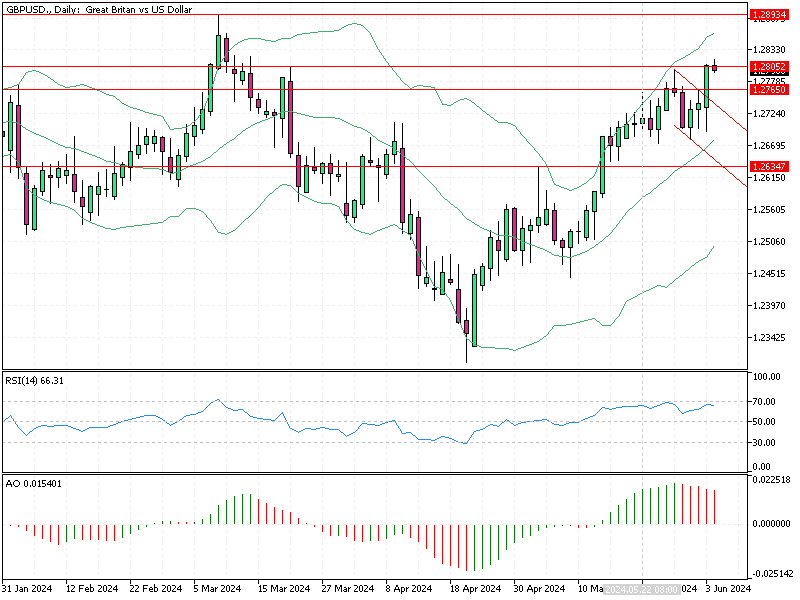

The British pound has recently experienced a decline, falling to $1.28 (GBP/USD)after investors capitalized on its impressive performance in May, where it rose by 2%. This week is relatively quiet for UK-specific economic events, with the spotlight on the European Central Bank (ECB) and US employment data.

ECB Set for First Rate Cut Since 2016

The ECB is poised to cut interest rates on Thursday, marking its first reduction since 2016. Markets expect the ECB to ease rates by around 57 basis points in 2024. The Bank of England (BoE) is projected to reduce rates by 33 basis points. Although British inflation has declined, it hasn’t dropped as significantly as anticipated, diminishing the chances of multiple rate cuts by the BoE this year.

Bank of England Eyes September for Cuts

Moreover, the political landscape adds to the uncertainty, with the early July general election influencing market sentiment. The Bank of England’s next policy meeting is set for June 20, but current UK swap rates suggest a rate cut is unlikely before September.

Investors should monitor these developments to make informed decisions. Understanding the broader economic context, such as central bank policies and political events, is crucial for effectively navigating the financial markets.

Comments are closed.