GBPUSD Fundamental Analysis – 6-June-2024

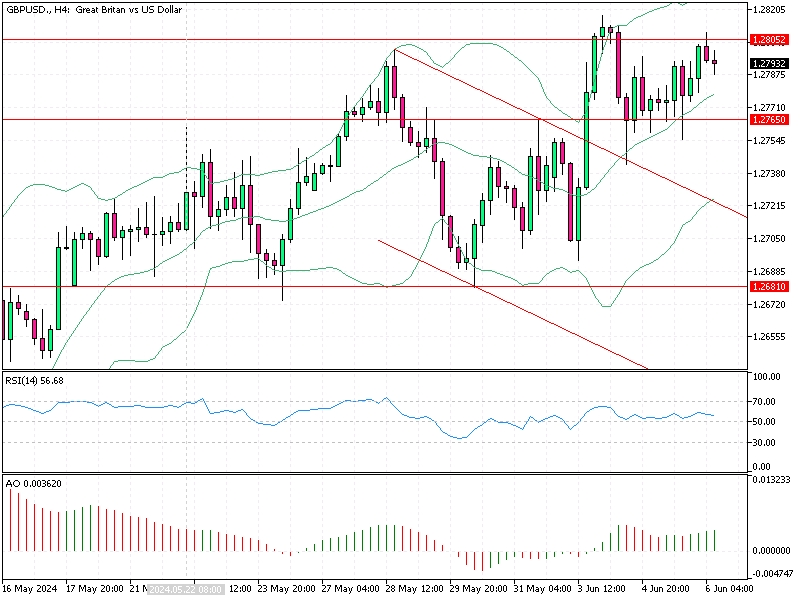

GBP/USD—The British pound recently dipped to $1.27, primarily because investors decided to cash in after its best monthly performance this year, which saw a 2% rise in May.

This week’s economic calendar is relatively quiet for the UK, with no significant events expected to influence the pound directly. Instead, investors are paying close attention to two critical factors: the European Central Bank (ECB) decision and the US employment data.

Diverging ECB and BoE Policies Impact Markets

On Thursday, the ECB is anticipated to reduce interest rates for the first time since 2016. The market predicts the ECB will cut rates by around 57 basis points throughout 2024, while the Bank of England (BoE) is expected to reduce rates by only 33. This divergence in monetary policy between Europe and the UK influences investor sentiment and the pound’s performance.

British Inflation Decline Falls Short

Recent data shows that British inflation has decreased, but not as significantly as analysts had expected. This modest decline in inflation suggests that the BoE might not implement multiple rate cuts this year, which also affects the pound’s outlook. The political landscape adds to the uncertainty, with an early July general election creating additional volatility.

Bank of England June 20 Meeting Insights

The Bank of England’s next meeting is on June 20, but current UK swap rates indicate that a rate cut is unlikely before September. Investors are watching these developments closely to make informed decisions about their investments in the pound. Understanding these factors can help readers navigate the complexities of the current economic environment.

Comments are closed.