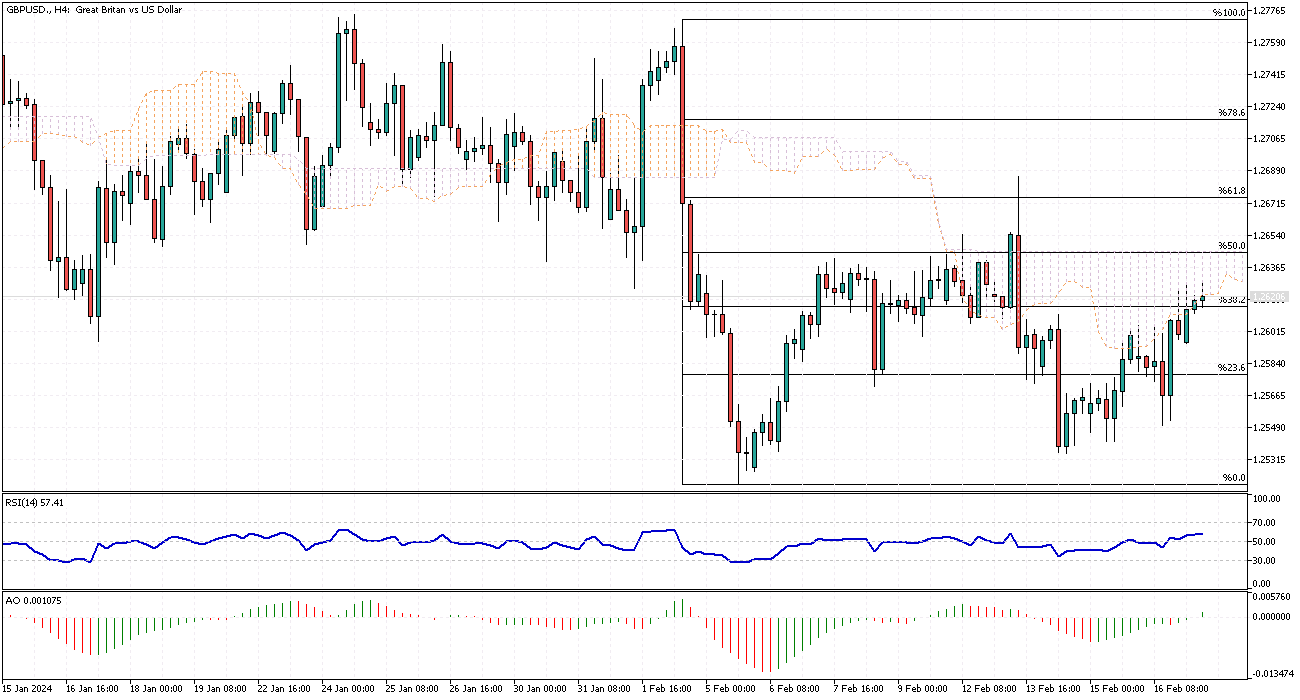

GBPUSD Fundamental Analysis – February-19-2024

GBPUSD – The British pound has found stability, hovering around the $1.26 mark, as the market assimilates various economic reports and their potential effects on future decisions by the Bank of England. The latest updates have shown a surprising uptick in UK retail sales, which have surged to the highest rate in almost three years during January, surpassing analysts’ forecasts.

This positive shift contrasts sharply with the preliminary data indicating a modest 0.3% shrinkage in the UK’s economy for the last quarter of 2023. This downturn marks the country’s entry into its first technical recession since the economic disruptions caused by the COVID-19 pandemic in 2020.

GBPUSD Fundamental Analysis

The inflation landscape offers a mixed but somewhat hopeful picture despite the recessionary pressures. The inflation rate for January stood firm at 4%, deviating slightly below the market expectations of 4.2% and the Bank of England’s forecast of 4.1%.

This stability in price levels amidst economic challenges suggests a nuanced balance between consumer demand and pricing dynamics. Additionally, the period witnessed a stronger-than-anticipated surge in wage growth during the fourth quarter, hinting at underlying strength in the labor market. This factor could be crucial in shaping the central bank’s monetary policy, as wage trends are closely watched indicators for future inflationary pressures.

Central Bank’s Optimism and Economic Recovery Signs

The Governor of the Bank of England, Andrew Bailey, has acknowledged the recent data with a cautiously optimistic tone, particularly welcoming the latest inflation figures. His remarks underscore a sense of gradual but tangible progress in the economic landscape, hinting at the early stages of recovery. This perspective is vital as it reflects the central bank’s balancing act between stimulating economic growth and controlling inflation.

The improved retail sales and wage growth could signal a rebound in consumer confidence and spending, essential for driving the post-recession recovery. However, the central bank remains vigilant, ready to adjust its policies in response to evolving economic indicators as it navigates the complexities of post-pandemic recovery and global economic challenges.

Comments are closed.