New Zealand Economic Indicators Influence NZDUSD

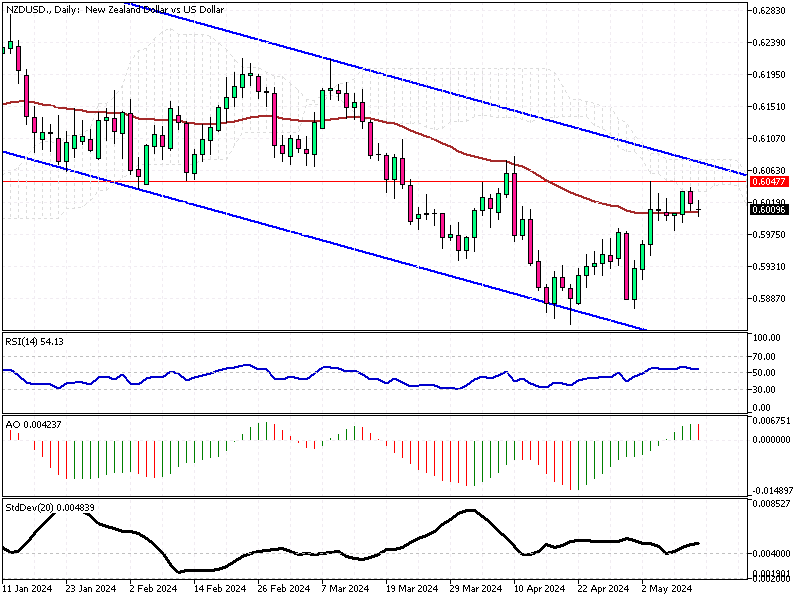

The New Zealand dollar has slightly decreased, settling at $0.60 (NZDUSD), influenced by the continuing decline in the country’s 2-year inflation expectations for the second quarter.

This trend supports the growing anticipation among investors that the Reserve Bank of New Zealand (RBNZ) might begin reducing interest rates towards the end of the year. Although inflation expectations are declining, it’s noteworthy that annual food inflation experienced a slight increase to 0.8% in April from 0.7% the previous month.

New Zealand Economic Indicators Influence NZDUSD

The economic scenario is further complicated by the BNZ Performance of Services Index, which dipped to its lowest point since January 2022, at 47.1 in April. Despite these figures, the RBNZ is expected to maintain the interest rate at 5.5% in its upcoming meeting.

This decision aligns with the OECD’s advice, suggesting that the central bank should keep its policy tight until it is evident that inflation is steadily returning to the target range. Nonetheless, financial markets are betting on a rate cut as early as October.

Market Watch: Global Influences

Investors remain vigilant, with eyes now turned towards the United States for upcoming economic data releases later this week. These insights are crucial as they could significantly impact the Federal Reserve’s decisions on interest rates, thereby affecting global currency markets, including the New Zealand dollar.

Understanding these interconnected elements will help forex traders and investors make more informed decisions in a fluctuating economic landscape.

Comments are closed.