NZDUSD Fundamental Analysis – 14-August-2024

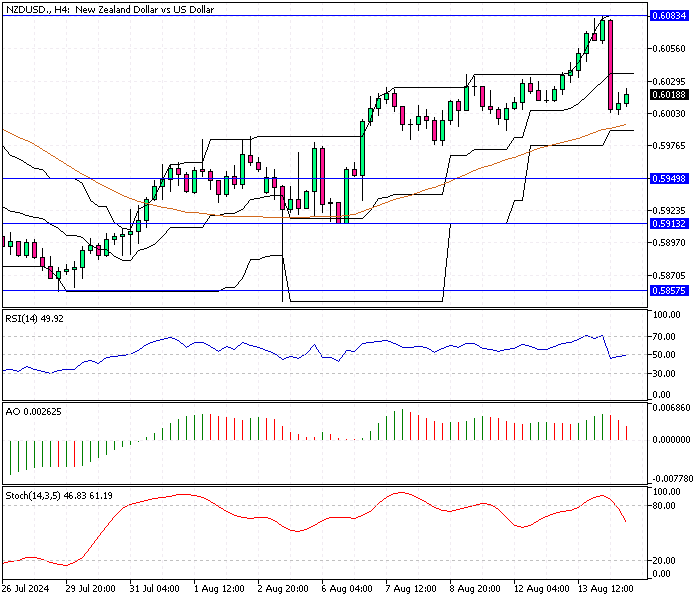

On Wednesday, the New Zealand dollar experienced a significant drop, losing about 1% of its value and settling near $0.601 (NZD/USD). This decline followed the Reserve Bank of New Zealand’s (RBNZ) surprising decision to lower interest rates.

The RBNZ cut its official cash rate by 25 basis points to 5.25%, the first reduction since March 2020.

RBNZ’s Strategy to Tackle Cooling Price Pressures

The central bank’s decision to reduce the rate comes as it observes a cooling in price pressures across the economy. The RBNZ anticipates that annual inflation will return to its target range of 1 to 3% by the third quarter of this year.

Despite this optimistic outlook, the bank signaled that it would maintain a tight monetary policy for the foreseeable future to ensure stability. The RBNZ also provided projections, indicating that the cash rate could fall to 4.92% by the end of this year and further to 3.85% by the close of 2025.

Market Expectations and the Kiwi’s Performance

Market analysts had anticipated a 25 basis point rate cut earlier in the week, with nearly 69% expecting this outcome. However, most economists believed the RBNZ might hold the rates steady.

Before the rate cut announcement, the New Zealand dollar reached a nearly four-week high of $0.608 on Tuesday. This spike was influenced by a weaker US dollar, which had dropped following disappointing US Producer Price Index (PPI) data for July.

The softer PPI figures increased the likelihood of a significant rate cut by the Federal Reserve in September, impacting currency markets.

Understanding the Impact on Global Markets

The RBNZ’s unexpected rate cut has broader implications for global markets. As central banks worldwide adjust their policies in response to changing economic conditions, currency values are directly impacted.

The New Zealand dollar’s recent fluctuations highlight how interconnected global economies are and how central bank decisions can immediately affect currency markets. Staying informed about these developments is crucial for making strategic financial decisions for investors and businesses.

By closely monitoring central banks’ actions and understanding their rationale, one can better anticipate market movements and manage risks effectively. The situation with the New Zealand dollar serves as a reminder of the dynamic nature of global financial markets and the importance of adapting to new economic realities.

Comments are closed.