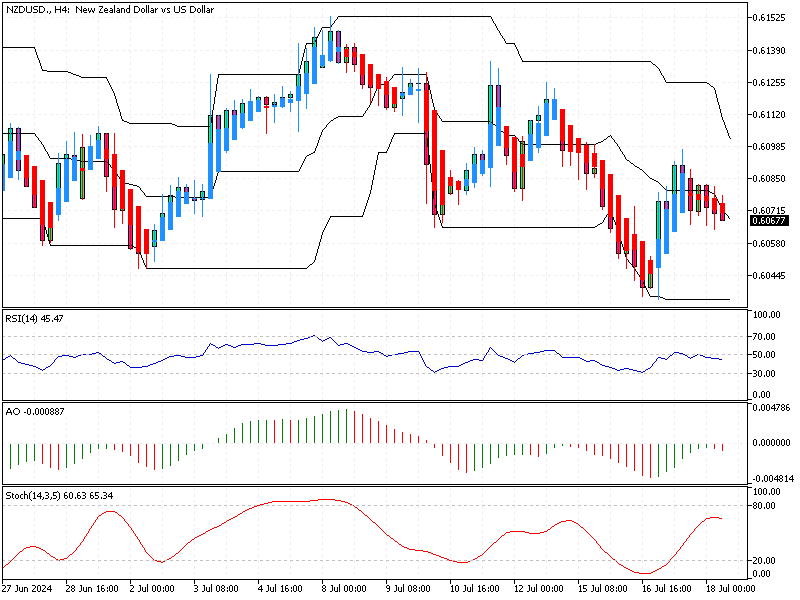

NZDUSD Fundamental Analysis – 18-July-2024

The NZD/USD currency pair recently dipped to around $0.607, driven by growing expectations of imminent rate cuts by the Reserve Bank of New Zealand (RBNZ). This movement overshadowed an increasingly dovish outlook on US monetary policy. Here’s a closer look at the factors influencing these trends and what they might mean for the future.

New Zealand’s Inflation and Monetary Policy

Recent data reveals that New Zealand’s annual inflation rate has eased to 3.3% in the second quarter, down from 4% in the previous period. While this is the lowest rate in three years, it still sits above the RBNZ’s target range of 1-3%. Despite this, the inflation figure was below the central bank’s expectations of 3.6%, suggesting that inflationary pressures are cooling faster than anticipated.

In response to these developments, the RBNZ has signaled a dovish shift, leading markets to anticipate a total easing of 70 basis points by the end of the year. This would likely begin with an initial rate cut as soon as next month. Rate cuts stimulate economic activity by making borrowing cheaper and boosting spending and investment.

US Dollar and Federal Reserve Expectations

The US dollar has been weakening broadly on the other side of the Pacific. This trend is fueled by bets that the Federal Reserve will implement multiple rate reductions this year. Lower interest rates in the US reduce the return on investments denominated in dollars, making the currency less attractive to investors and leading to a depreciation.

NZDUSD Fundamental Analysis – 18-July-2024

For investors and market watchers, these dynamics present both opportunities and risks. The anticipated rate cuts in New Zealand could support economic growth by reducing borrowing costs, but they also signal concern about the economic outlook. Similarly, the expected rate reductions in the US reflect worries about economic slowdown but could temporarily boost markets by making credit cheaper.

Final Word

In summary, New Zealand’s monetary policy and the US dollar’s movements highlight the complex factors that drive currency markets. Understanding these can help investors make more informed decisions, balancing potential gains against the underlying economic signals. Staying informed and adaptable is key in navigating these shifting economic landscapes.

Comments are closed.