NZDUSD Fundamental Analysis – 28-June-2024

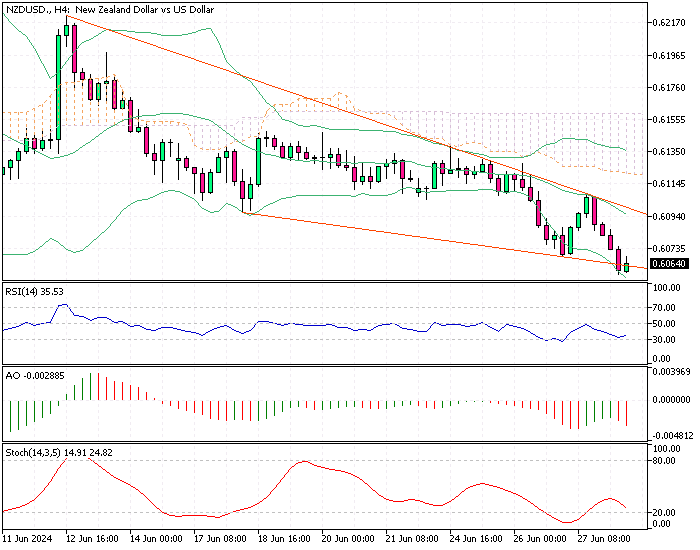

The New Zealand dollar dropped slightly to $0.606, staying at its lowest since mid-May. Investors are waiting for the release of the US PCE inflation data, which might hint at the Federal Reserve’s rate cut plans.

On Thursday, the Kiwi did not gain much even though the US dollar weakened due to poor economic reports and dovish remarks from Atlanta Fed President Bostic.

New Zealand Reserve Bank’s Stable Policy Until 2025

In New Zealand, the Reserve Bank is expected to keep its policy stable until mid-2025 because inflation risks remain high. However, investors expect a rate cut in November. The Kiwi has declined about 1.3% this month but is up 1.4% this quarter. The first US presidential debate between Donald Trump and Joe Biden did not significantly affect the market.

NZDUSD Fundamental Analysis – 28-June-2024

The NZD/USD currency pair has been under pressure, reflecting a nuanced interplay of global and domestic factors. The New Zealand dollar has recently dipped to $0.606, its lowest since mid-May. This decline is partly due to market anticipation of the US PCE inflation data, which could provide insights into the Federal Reserve’s potential rate cuts. The US dollar’s slight weakness, spurred by poor economic data and dovish comments from the Atlanta Fed President, did not significantly boost the Kiwi.

Domestically, the Reserve Bank of New Zealand (RBNZ) is expected to maintain its current policy stance until at least mid-2025, given the persistent inflation risks. Despite this, investors have a broad expectation for a rate cut in November, which might be driving some of the current trends in the NZD/USD pair.

Over the month, the Kiwi has decreased by approximately 1.3%, reflecting short-term pressures. However, it has seen a quarterly gain of 1.4%, indicating some resilience. The recent US presidential debate did not substantially impact the market, suggesting that political events are secondary to economic indicators influencing the NZD/USD movements.

Comments are closed.