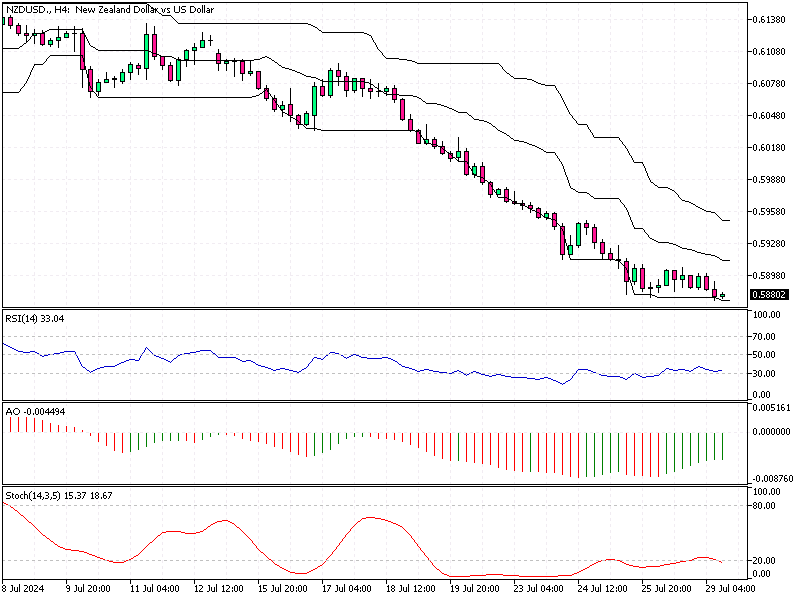

NZDUSD Fundamental Analysis – 29-July-2024

The New Zealand dollar has stabilized around $0.588, buoyed by a subdued US dollar following a mild US inflation report. This report has set the stage for the Federal Reserve’s highly anticipated interest rate cut in September.

Investors and markets are keenly observing the upcoming US central bank meeting this week to understand the potential rate cuts for the remainder of the year.

Factors Behind the Kiwi’s Decline

Last week, the New Zealand dollar experienced a 2% drop, reaching a three-month low. Several factors drove this decline, including a sell-off in global share markets and the forced unwinding of carry trades against the yen.

The lack of substantial easing measures and a weak economic outlook in China, New Zealand’s top trading partner, further contributed to the Kiwi’s downturn.

Domestic Influences on the New Zealand Dollar

In addition to international factors, domestic economic data also played a role in the Kiwi’s performance. Soft domestic inflation data prompted markets to anticipate early rate cuts from the Reserve Bank of New Zealand (RBNZ).

According to market pricing, there is a 44% chance of a rate cut in August. This expectation is influenced by the need to stimulate the local economy amid global uncertainties.

- Also Read: AUDUSD Fundamental Analysis – 29-July-2024

NZDUSD Fundamental Analysis – 29-July-2024

Looking ahead, the stability of the New Zealand dollar will depend heavily on decisions made by the Federal Reserve and the RBNZ. A US rate cut in September could lead to further stability or even a slight appreciation of the Kiwi. However, continued weakness in global markets and China’s economic outlook may pose challenges. Investors should closely monitor central bank meetings and financial indicators to make informed decisions.

By understanding these dynamics, readers can better anticipate market movements and make informed investment choices. The interplay between international and domestic factors will be crucial in shaping the economic landscape in the coming months.

Comments are closed.