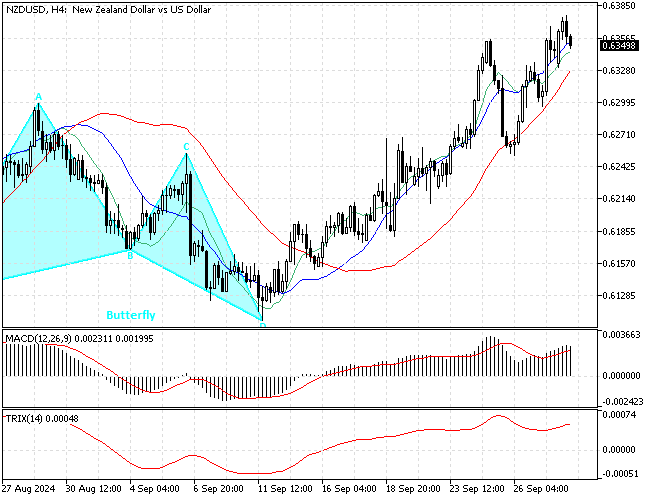

NZDUSD Fundamental Analysis – 30-September-2024

The NZD/USD conversion rate has significantly increased, reaching approximately $0.634. This value is near its highest in 14 months, a peak that occurred earlier in the session.

This rise was influenced by less favorable economic data from the United States, which has increased the likelihood of substantial interest rate reductions by the Federal Reserve within the year.

Global and Domestic Factors Influencing the Kiwi

Globally, investor confidence was lifted following China’s announcement of new economic stimulus measures, a significant trading ally. On the domestic front, New Zealand’s financial outlook has brightened, with a notable increase in business confidence in September, reaching its highest point since April 2014.

Consumer confidence has also increased, marking its strongest since January 2022 after rising for three consecutive months.

Anticipations in Monetary Policy

The monetary policy landscape in New Zealand is also of interest, with expectations leaning towards a rate cut by the Reserve Bank of New Zealand. The market anticipates a 67% chance that the bank will lower interest rates by half a percentage point in its upcoming October meeting.

Simplified Conclusion

In summary, the New Zealand dollar has shown remarkable strength, influenced by weaker U.S. economic reports and fresh stimulus from China.

This, coupled with growing optimism in New Zealand’s economic indicators like business and consumer confidence, sets the stage for potential monetary easing by the country’s central bank. The combined effect of these factors holds the Kiwi in a strong position in the global market.

Comments are closed.