NZDUSD Fundamental Analysis – 5-August-2024

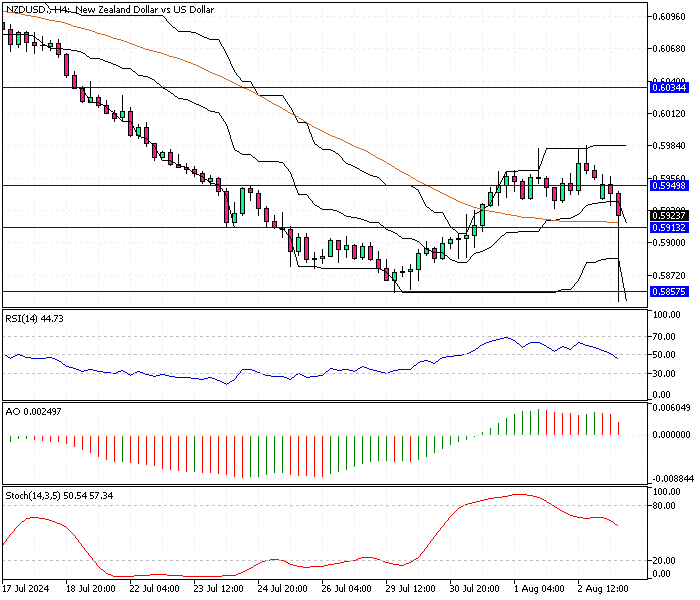

The New Zealand dollar recently depreciated to around $0.591 (NZD/USD), following a brief rebound of 1.2% last week. The decline is mainly attributed to a disappointing US jobs report, which has raised fears of a potential recession.

As a result, markets are now expecting more significant rate cuts from the Federal Reserve. This sentiment shift reflects growing concerns over the US economy’s health and impact on global financial markets.

Upcoming Reserve Bank of Australia Decision

Investors eagerly await Tuesday’s Reserve Bank of Australia’s (RBA) interest rate decision. Market consensus suggests that the RBA will likely hold interest rates steady. This decision is crucial as it will influence the region’s investor sentiment and market movements.

A rate hold indicates a cautious approach amid uncertain economic conditions, aiming to balance inflation control with economic growth.

Focus on New Zealand’s Labor Data

In New Zealand, the spotlight is on the upcoming labor data release. Analysts predict an increase in the unemployment rate to 4.7% for the second quarter, up from 4.3% in the previous quarter. This anticipated rise could signal underlying weaknesses in the labor market, potentially influencing the Reserve Bank of New Zealand’s (RBNZ) monetary policy decisions.

- Also read: AUDUSD Fundamental Analysis – 5-August-2024

NZDUSD Fundamental Analysis – 5-August-2024

The Reserve Bank of New Zealand (RBNZ) is scheduled to meet on August 14th. Current market predictions indicate a 35% chance of a rate cut during this meeting, with a stronger expectation of action by October.

Investors and analysts will be closely monitoring the RBNZ’s statements and decisions, as they will provide critical insights into the central bank’s approach to navigating economic challenges and supporting the country’s financial stability.

In conclusion, the interplay between global economic indicators, regional central bank decisions, and domestic labor data will significantly shape the New Zealand dollar’s trajectory and broader market dynamics in the coming weeks.

Comments are closed.