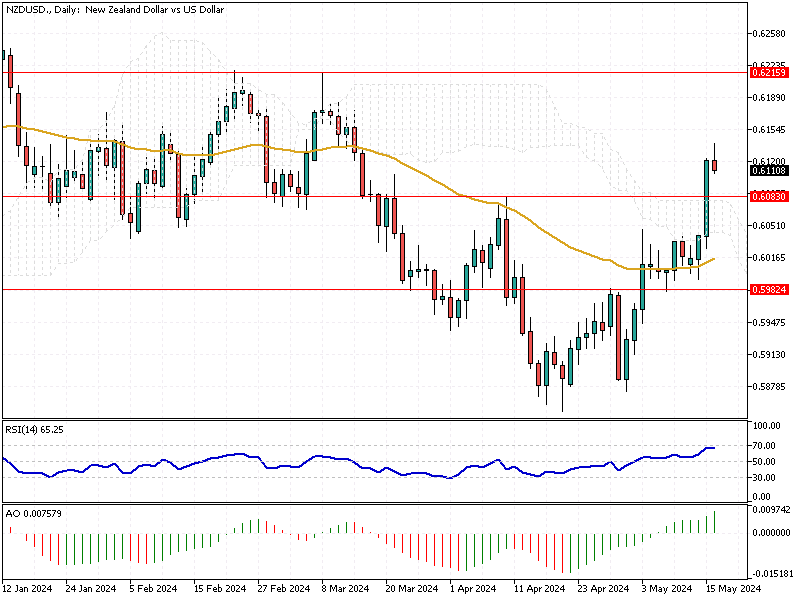

NZDUSD – Kiwi Gains as US Data Weakens Dollar

The New Zealand dollar is strong at around $0.61 (NZDUSD), its highest level in two months. This surge is due to recent US economic reports that have weakened the US dollar.

NZDUSD – Kiwi Gains as US Data Weakens Dollar

On Wednesday, data revealed slower-than-expected growth in US consumer prices for April and flat retail sales. This has increased the likelihood that the Federal Reserve (Fed) will cut interest rates twice this year.

External factors, particularly the Chinese Yuan, also lifted the NZD. Reports that China’s government might buy unsold homes to reduce oversupply strengthened the Yuan. This, in turn, positively affected the NZD, as a stronger Yuan often supports other currencies in the region.

RBNZ’s Current and Future Rate Plans

Bloomberg—Domestically, the Reserve Bank of New Zealand (RBNZ) is expected to keep its interest rate steady at 5.5% in its meeting on May 22nd. Policymakers are cautious about reducing rates until they see clear evidence that inflation is consistently around their 2% target.

Inflation Expectations Influence Future Decisions

Recent data showed that New Zealand’s 2-year inflation expectations for the second quarter have dropped to their lowest point in nearly three years. This has fueled speculation that the RBNZ might consider cutting rates later in the year if this trend continues.

Conclusion

These developments suggest that the NZD could remain strong in the near term. For forex traders and investors, monitoring US economic indicators and RBNZ announcements will be crucial for making informed trading decisions.

Comments are closed.