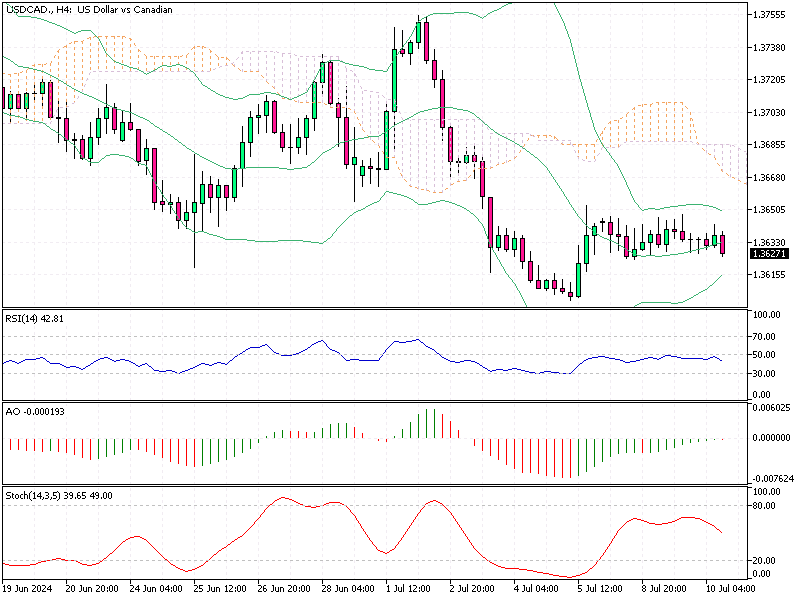

USDCAD Fundamental Analysis – 10-July-2024

The Canadian dollar recently weakened past $1.362 (USD/CAD), retreating from a one-month high of 1.361 observed on July 4th. This movement is primarily attributed to signs of a weakening Canadian labor market, though the decline was tempered somewhat by a weakening US dollar.

Canada’s Jobless Rate Hits 6.4% in June

In June 2024, Canada’s unemployment rate rose to 6.4%, exceeding expectations of 6.3% and marking the highest level since January 2022. This uptick in unemployment reflects growing concerns about the health of the Canadian economy. The labor market showed further strain as Canadian employment fell by 1.4K jobs, contrary to an anticipated increase of 22.5K.

These figures align with the Bank of Canada’s stance that higher interest rates are beginning to impact the job market. The rise in unemployment and the unexpected job losses bolster arguments for potential rate cuts to stimulate the economy. This, in turn, could provide limited support for the Canadian dollar, commonly referred to as the loonie.

Canadian Economy Feels Rate Hike Impact

Interest rates play a crucial role in economic performance. Higher rates typically aim to curb inflation but can also slow down economic growth by making borrowing more expensive. The recent data indicates that the Canadian economy might feel the pressure of these higher rates, as evidenced by the weakening labor market.

The Bank of Canada may consider cutting rates to support economic growth. However, this decision is complex and involves balancing the need to control inflation and foster employment and economic activity. If the central bank opts for rate cuts, it could lead to a weaker Canadian dollar in the short term as investors seek higher returns elsewhere.

Fed May Ease Interest Rates as Jobs Lag

Across the border, the US economy is also showing signs of strain. A recent jobs report revealed weaker-than-expected employment figures, with downward revisions for the second quarter. This has fueled speculation that the Federal Reserve may adopt a more dovish stance, potentially slowing the pace of interest rate hikes or even considering cuts.

A more dovish Federal Reserve could weaken the US dollar, which might provide some relief to the Canadian dollar. However, suppose both the Canadian and US central banks move towards cutting rates. In that case, the relative strength of each currency will depend on the specifics of their economic conditions and monetary policies.

USDCAD Fundamental Analysis – 10-July-2024

Given the current economic data, investors and policymakers must stay informed about labor market trends and central bank actions. The weakening Canadian labor market suggests that rate cuts might be on the horizon, which could impact the Canadian dollar. At the same time, changes in US monetary policy will also play a significant role in determining the loonie’s value against the US dollar.

Final Word

In conclusion, the recent economic indicators point towards a period of adjustment and potential monetary policy shifts in Canada and the US. Understanding these dynamics is essential for making informed decisions in the current economic landscape.

Comments are closed.