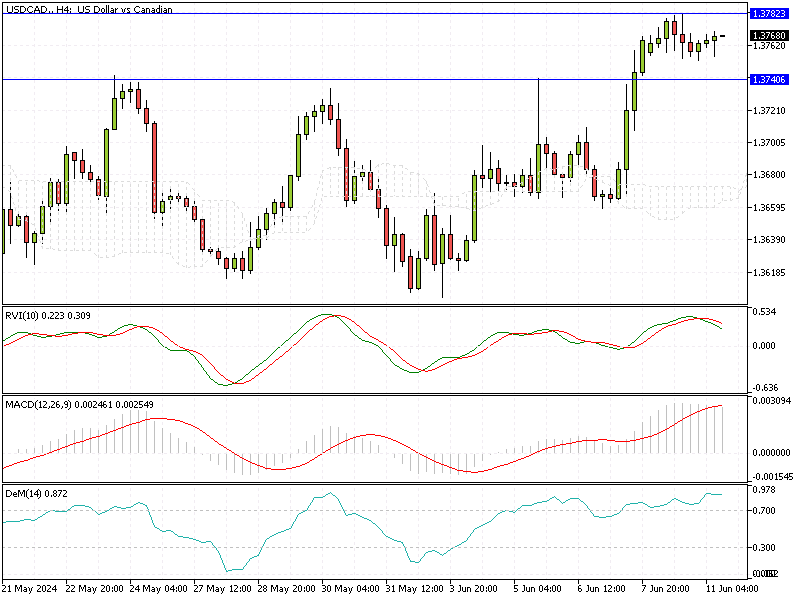

USDCAD Fundamental Analysis – 11-June-2024

USD/CAD—In June, the Canadian dollar weakened beyond 1.37 per USD, influenced by a stronger US dollar following a significant increase in US payrolls. This development supports the likelihood of a more aggressive stance from the Federal Reserve.

Canada’s Job Market Defies Expectations

On the domestic front, Canada’s labor data presented a mixed picture, reinforcing the Bank of Canada’s decision to maintain its strategy of rate cuts this year. Although the unemployment rate climbed to a 2021 high of 6.2% in May, the job market showed resilience, with more jobs added than anticipated and wages increasing sharply.

Bank of Canada Lowers Interest Rate to 4.75%

Earlier in the year, the Bank of Canada reduced its key interest rate by 25 basis points to 4.75%, following 11 months of maintaining rates at a 22-year high. This rate cut was in response to several factors: a consistent trend of disinflation approaching the target, lower-than-expected GDP growth in the first quarter, and fluctuations in the labor market.

Summary

For those monitoring economic indicators, these data points suggest that the Bank of Canada is taking a cautious yet proactive approach to navigating the complexities of the current economic landscape.

Understanding these dynamics can help make informed decisions about investments, savings, and financial planning amidst evolving market conditions.

Comments are closed.