USDCAD Fundamental Analysis – 12-September-2024

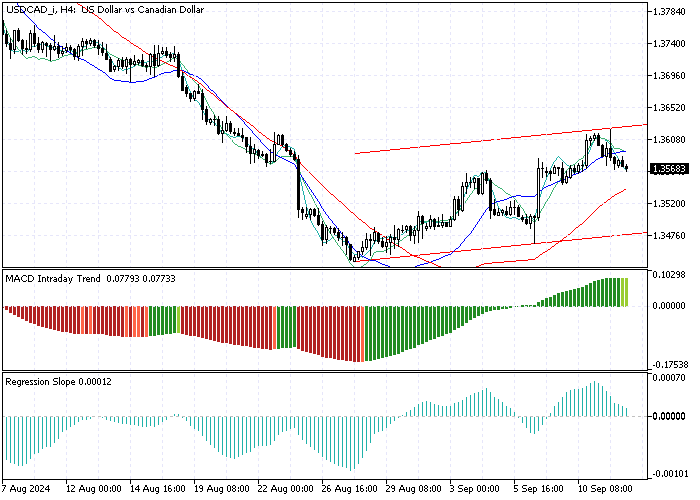

The Canadian dollar dropped to more than $1.356 (USD/CAD) after reaching a five-month high of 1.344 on August 27th. This decline occurred as investors reacted to recent labor market data from both Canada and the US.

Rising Unemployment in Canada

Canada’s unemployment rate increased to 6.6% in August, up from 6.4% in July. This is the highest rate seen since October 2021 and higher than the predicted 6.5%.

The rise in unemployment supports the Bank of Canada’s view that the labor market is cooling down. This aligns with the Bank of Canada’s recent rate cut of 25 basis points, where policymakers pointed out concerns over slowing job growth and the risk of a weaker economy.

Bank of Canada Balances Inflation Concerns

Even though the labor market is slowing, Governor Macklem emphasized ongoing inflation pressures, particularly in the housing market and some services.

These concerns keep inflation high, making the Bank of Canada’s stance seem cautious even as the currency weakened.

US Labor Market Data Affects the Dollar

At the same time, the US also released job data that was less than impressive. Job growth in August fell short of expectations, and there were downward revisions for June and July.

These factors led to increased speculation that the Federal Reserve might consider a significant interest rate cut, which put pressure on the US dollar.

Conclusion: The Canadian Dollar Faces Mixed Pressures

In summary, the Canadian dollar’s recent weakening results from rising unemployment in Canada and concerns over inflation despite the Bank of Canada’s easing measures.

At the same time, weaker job data in the US is adding pressure on the US dollar, which could lead to changes in monetary policy. Both economies face unique challenges, likely influencing currency movements in the coming months.

Comments are closed.