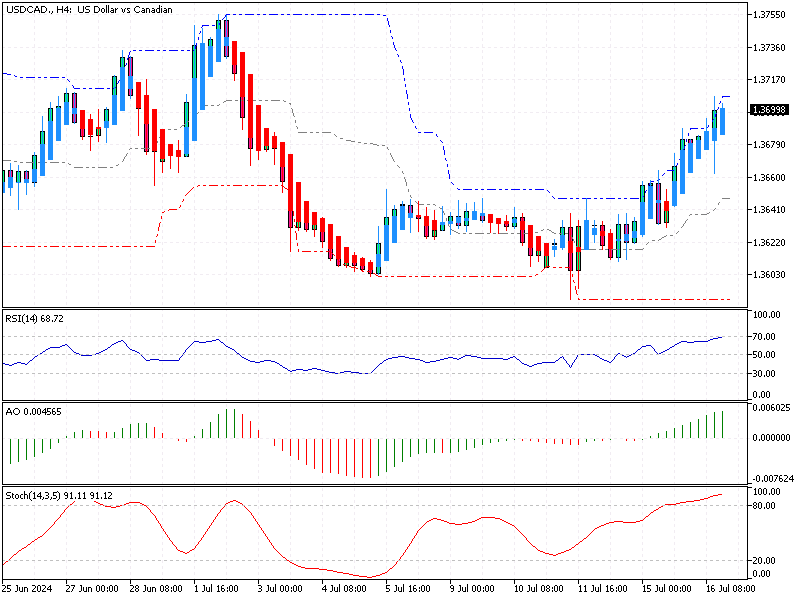

USDCAD Fundamental Analysis – 16-July-2024

The Canadian dollar has recently weakened, trading around $1.37 (USD/CAD) after reaching an eight-week high of 1.36 on July 4th. This decline is primarily due to a stronger US dollar, influenced by an assassination attempt on former President Donald Trump over the weekend. Such geopolitical events can create market uncertainty, boosting demand for the US dollar as a safer investment.

Canadian Firms Pessimistic on Future Sales

The Bank of Canada’s (BoC) latest Business Outlook Survey revealed continued pessimism among Canadian firms. This sentiment stems from weak sales expectations and high equipment costs, discouraging investment. When businesses expect lower sales, they are less likely to invest in new equipment or expand their operations, which can slow economic growth.

Canada’s Job Market Faces Unexpected Slump

Adding to the economic concerns, Canada’s unemployment rate rose to its highest level since January 2022 in June. This increase was unexpected, with a surprising decline of 1.4K jobs instead of the anticipated 22.5K job gain. This situation underscores the BoC’s worries about the adverse effects of higher interest rates on the job market.

Higher interest rates generally aim to control inflation but can also make borrowing more expensive, leading to reduced spending and investment and potentially higher unemployment.

Canada’s CPI Inflation Data Sparks Interest

Looking ahead, all eyes are on the upcoming release of Canada’s Consumer Price Index (CPI) inflation data. The CPI measures the average price change consumers pay for a basket of goods and services over time. If inflation remains high, the BoC might hesitate to cut interest rates further, even though a recent quarter-point reduction was made in June. Lowering rates could stimulate economic activity but might also risk higher inflation.

USDCAD Fundamental Analysis – 16-July-2024

In conclusion, the Canadian dollar’s recent decline is tied to external geopolitical events and domestic economic challenges. With rising unemployment and cautious business sentiment, the forthcoming inflation data will be crucial in shaping the BoC’s monetary policy decisions. Investors and businesses should stay informed about these developments to effectively navigate the uncertain economic landscape.

Comments are closed.