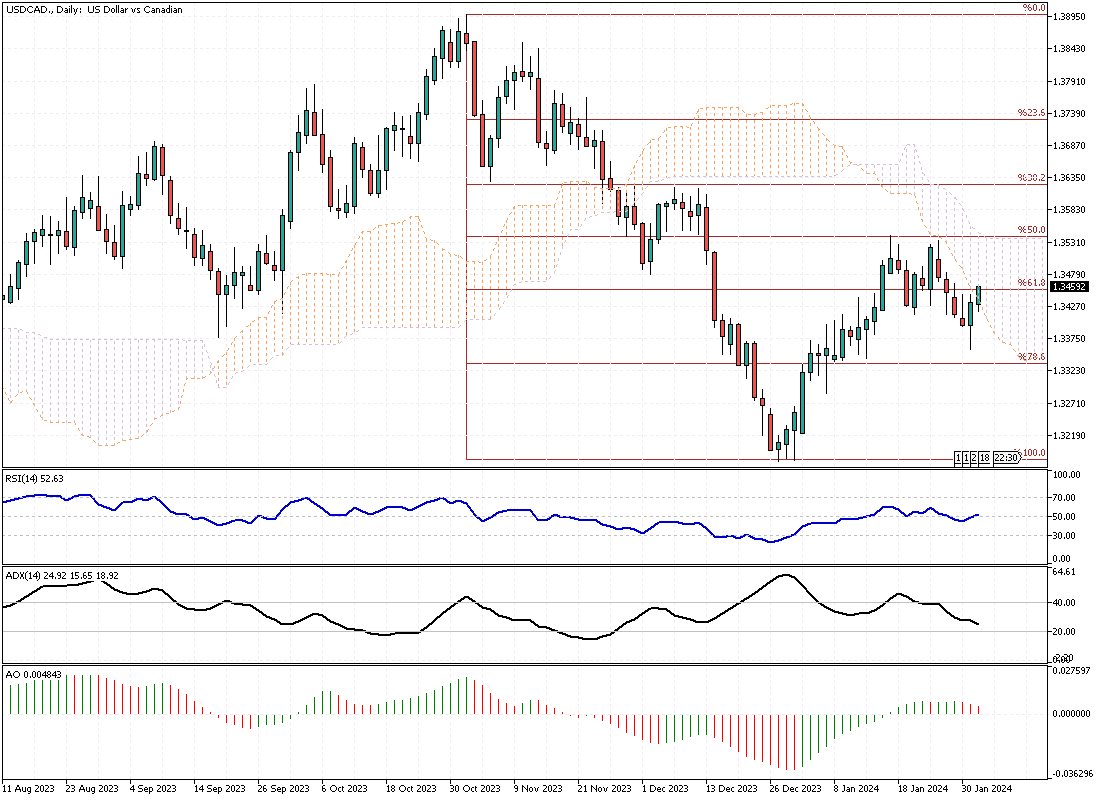

USDCAD Fundamental Analysis – February-1-2024

The Canadian dollar has seen a notable appreciation in recent trading sessions, crossing the 1.35 threshold against the US dollar. This move signifies a rebound from its low point over the past month, where it briefly dipped to 1.352 against the USD as of January 24th. A significant factor behind this shift is the rise in oil prices. This uptick in oil benchmarks comes despite the overarching strength of the US dollar, indicating a specific resilience in the Canadian currency. The robust GDP growth figures from the United States and proactive economic stimulus efforts from China contribute to the optimism in oil markets.

Moreover, a reduction in oil supply, as highlighted by recent reports from the Energy Information Administration (EIA) showing a substantial decrease in US stockpiles, coupled with escalating geopolitical tensions in the Red Sea region, has played a pivotal role in bolstering oil prices, thereby providing a lift to the Canadian dollar, often referred to as the loonie due to the bird depicted on the $1 coin.

Oil Dynamics and Economic Measures

The underlying strength of the loonie can be primarily attributed to the dynamics within the oil market. The global economic landscape, particularly the vigorous expansion of the US economy and the Chinese government’s stimulus actions, has fostered a renewed optimism about the oil demand. This optimism is further solidified by the EIA’s oil-demanding significant draws on US oil inventories, suggesting a tightening market.

Additionally, geopolitical developments, such as tensions in the Red Sea, can potentially disrupt supply chains, further supporting oil prices. As Canada is a significant oil exporter, these factors contribute to the strength of its currency. The loonie’s performance reflects Canada’s economic health and close ties to global energy markets, underlining the impact of external economic and geopolitical events on the Canadian economy.

Monetary Policy and Inflation

The Bank of Canada’s recent statements have indicated a cautious approach towards monetary policy, suggesting that interest rates may have peaked. This careful stance is driven by the persisting risks of inflation, which remain a concern for the economy. November’s data showing an increase in average weekly earnings to 4.1% underscores the inflationary pressures within the country. The central bank’s deliberation on the timing of potential rate cuts reflects an effort to balance economic growth with inflationary risks.

As inflation continues to be a significant factor in monetary policy decisions, the Bank of Canada’s strategies in navigating these financial challenges will be crucial for the Canadian dollar’s trajectory. This careful maneuvering highlights the complexities of managing a national currency in a fluctuating global economic environment, emphasizing the importance of monetary policy in stabilizing and fostering economic growth.

Comments are closed.