USDCAD Fundamental Analysis – February-14-2024

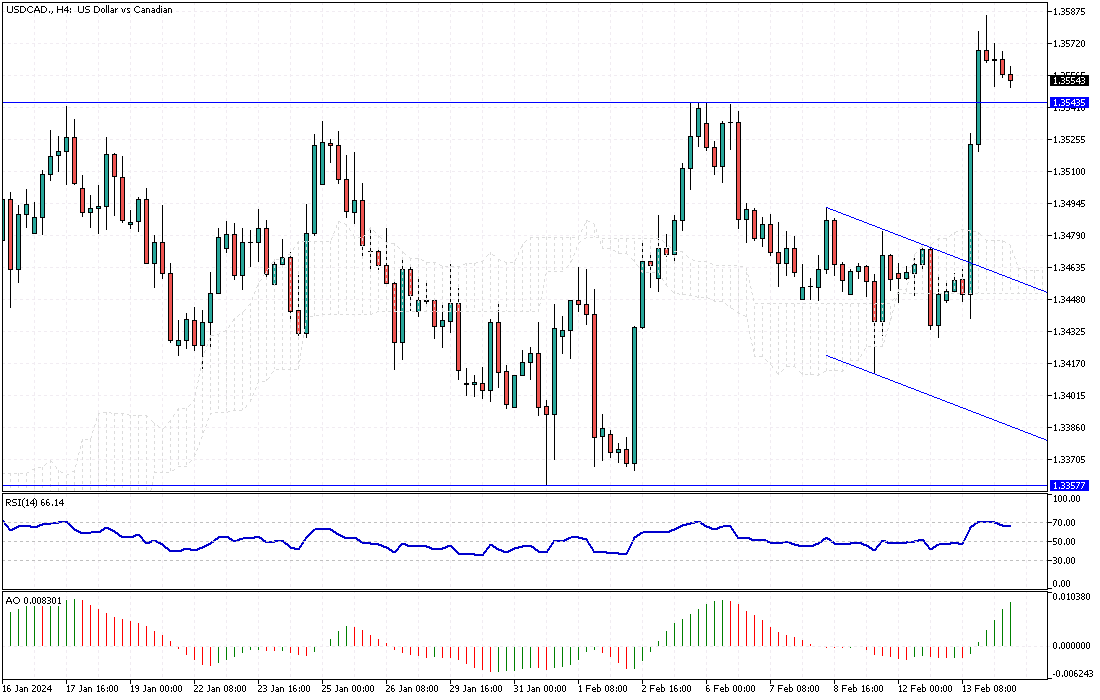

The Canadian dollar declined, surpassing the 1.35 mark against the USD (USDCAD) and nearing a two-month low of 1.345 recorded on February 9th. This movement was primarily triggered by persistent inflation in the United States, which adjusted the anticipated timeline for a Federal Reserve rate cut, consequently strengthening the U.S. dollar.

This development reversed some of the positive momentum the Canadian dollar had gained from recent robust labor market data within Canada. The greenback’s strength reflects broader economic trends and monetary policy expectations, affecting currencies worldwide, including the Canadian dollar.

Canadian Economy Shows Resilience Amid Challenges

Despite the external pressures, the Canadian economy displayed signs of resilience, as evidenced by the latest labor market report. In January, the Canadian labor market saw the addition of nearly 40 thousand jobs and a significant reduction in unemployment. About 20 thousand fewer individuals were classified as unemployed, leading to a decrease in the unemployment rate for the first time since December 2022.

This positive shift challenges the growing concerns over the Canadian economy’s health amid warnings from the Bank of Canada (BoC) policymakers about the stifling effects of high-interest rates on economic growth and the persistent inflation risks.

Policy Implications and Economic Outlook

The interplay between job market strength and monetary policy highlights a complex scenario for Canada’s economic outlook. While the BoC continues to caution about the dampening impact of high-interest rates on economic expansion, recent labor data inject a note of optimism. This suggests that despite the central bank’s concerns over inflationary pressures, the economy retains areas of robustness.

Policymakers and investors alike must navigate this nuanced landscape, balancing the need for inflation control with fostering economic growth. The coming months will be critical in determining whether these positive labor market trends can be sustained amidst external economic uncertainties and the BoC’s monetary policy stance.

Comments are closed.