USDCHF Fundamental Analysis – 10-June-2024

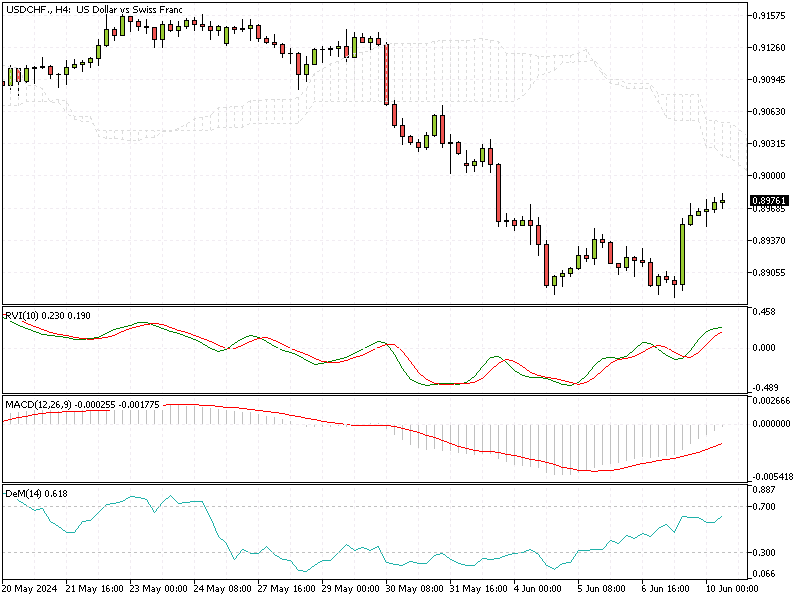

USD/CHF—The Swiss franc is steady at 0.897 per USD, near its two-month low. This stability comes from recent US data suggesting that the Federal Reserve may start to ease interest rates in September. Understanding these shifts is critical to making informed decisions for consumers and investors.

Swiss Inflation Steady at 0.3%

In May 2024, consumer prices rose by 0.3% in Switzerland compared to the previous month. This increase matches April’s rate and is slightly below the expected 0.4% rise. The steady inflation rate indicates a relatively stable economic environment, which can impact the Swiss franc’s value.

Stable prices mean that the cost of goods and services isn’t rising too quickly, helping consumers maintain purchasing power. The steady inflation rate suggests a predictable economic landscape for investors, which can influence investment strategies.

US Rate Cuts Impact on Swiss Franc

The potential easing of interest rates by the Federal Reserve in the US could affect global markets, including Switzerland. Lower US interest rates typically weaken the USD, strengthening the Swiss franc. This dynamic can influence everything from travel costs to international trade.

Final Words

Overall, monitoring these economic indicators helps consumers and investors navigate the financial landscape with confidence. Understanding these trends is crucial for making informed financial decisions in a fluctuating global economy.

Comments are closed.