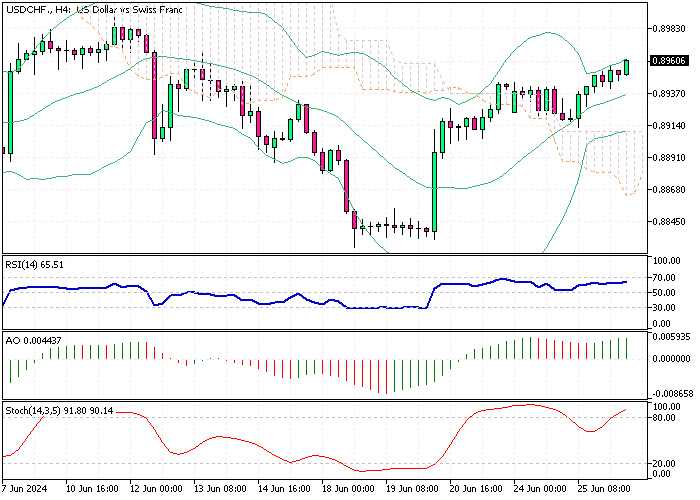

USDCHF Fundamental Analysis – 26-June-2024

USD/CHF—The Swiss franc dropped by nearly 0.5% to almost 0.896 against the USD following a 25 basis point reduction in the key interest rate by the Swiss National Bank, marking the second such cut in a row, which aligned with most investors expectations.

Officials highlighted a reduction in fundamental inflation pressures and focused on sustaining suitable monetary conditions. Switzerland’s inflation rate remained at 1.4% in May.

Franc Surges Amid French Political Instability

Before this adjustment, the franc performed strongly, reaching near three-month peaks against the dollar and four-month highs against the euro. This surge was partly due to the political instability in France and the emergence of far-right parties in the European Parliament elections, which drove investors towards safer assets.

USDCHF Fundamental Analysis – 26-June-2024

The USD/CHF pair has shown a recent weakening of the Swiss franc against the U.S. dollar, primarily driven by the Swiss National Bank’s (SNB) strategy of lowering interest rates. This deliberate reduction attempts to manage inflation, which remains controlled at 1.4%, suggesting a stable economic environment in Switzerland.

However, the impact of broader European political instability, notably in France, alongside shifts in the European Parliament, has bolstered the franc’s position as a haven during times of uncertainty. As the franc weakens due to domestic policy, it still benefits from external political tensions, creating a complex dynamic for traders.

The dual influence of local monetary policy and regional political developments will likely continue to direct the movement of the USD/CHF pair in the short term. This scenario suggests a cautious approach, with potential volatility driven by European political factors that may override local economic indicators.

Comments are closed.