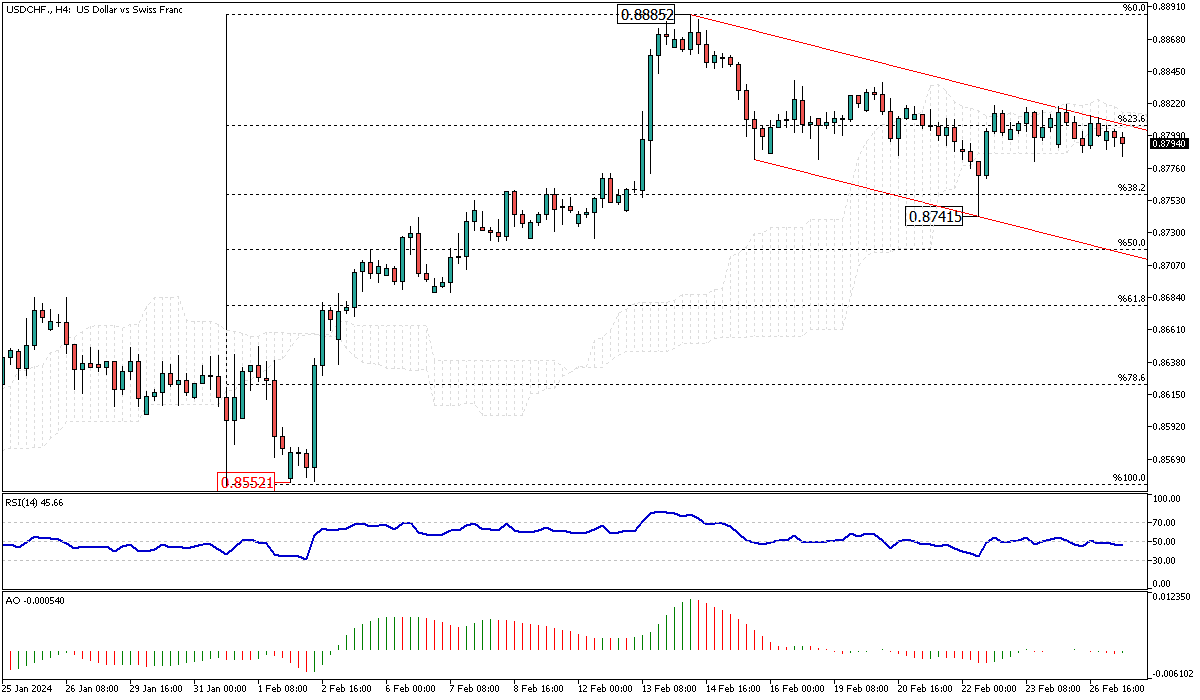

USDCHF Fundamental Analysis – February-27-2024

The Swiss franc has been trading around the 0.88 per USD level, keeping close to its three-month nadir of 0.89 per USD observed on February 13th. This positioning reflects the growing disparity between the economic landscapes of Switzerland and the United States, hinting at diverging approaches to monetary policy shortly. Switzerland’s economic indicators, particularly in inflation, contrast sharply with those of the U.S., setting the stage for potential shifts in financial strategy.

USDCHF Analysis: Swiss Inflation Dynamics

Switzerland witnessed a significant deceleration in headline inflation, which registered at 1.3% in January, notably falling short of the anticipated 1.7%. This marked the lowest inflation rate the country has seen in more than two years, consistently staying beneath the Swiss National Bank’s (SNB) upper inflation target of 2% for the seventh month in a row.

Despite the backdrop of phasing out electricity subsidies and modifications to the value-added tax system, inflation rates have not surged as expected. This unexpected trend has led to increased speculation that the SNB might commence lowering its benchmark policy rate sooner than anticipated, potentially as early as the first half of this year, with market forecasts even pointing towards a possible rate cut in March.

External Reserves and Their Impact on the Franc

Adding to the pressures on the Swiss franc, the SNB has been on a path of increasing its foreign exchange reserves for the second consecutive month as of January. This action is perceived as a reversal from the continuous decrease observed over the previous two years, bringing the reserve levels to their lowest in seven years.

The augmentation of foreign reserves could be seen as a strategic move to stabilize the franc amidst fluctuating global markets and domestic economic adjustments. This strategy and current inflation dynamics provide a nuanced view of the SNB’s approach to maintaining financial stability and its implications for the Swiss currency’s valuation against the dollar.

Comments are closed.