USDCHF Slips as Swiss Inflation Cools to %0.8

The Swiss Franc recently declined, trading at about 0.857 per USD. This drop came after Switzerland’s Swiss rate eased to 0.8%, falling below the market’s exmarket’s level of 1.1%.

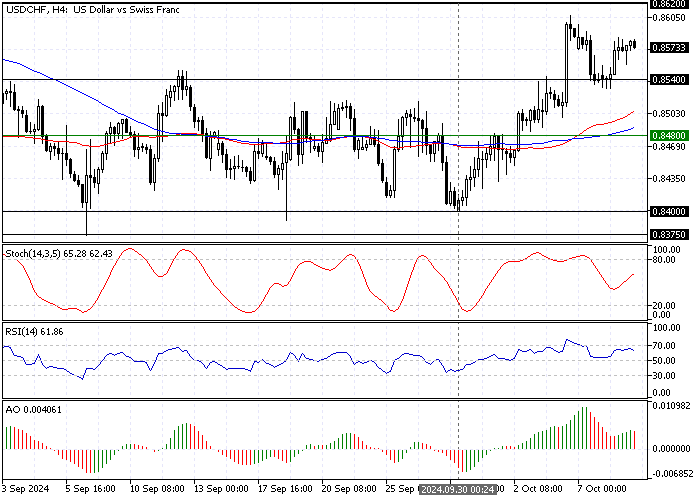

The daily chart below demonstrates the USD/CHF currency price and the key technical levels.

USDCHF Fundamental Analysis – 9-October-2024

The lower-than-expected inflation data has fueled speculation that the Swiss National Bank (SNB) might be more cautious in the coming months.

Many analysts now believe the SNB could move forward with a 50-basis-point interest rate cut during its December meeting. This outlook follows the SNB’s previous decision to lower its key interest rate by 25 basis points for the third time.

U.S. Dollar Gains Ground Amid Positive Economic Data

On the other hand, the U.S. dollar has been showing strength, climbing to its highest level in three weeks. This boost is mainly due to strong U.S. private employment figures, which have strengthened the belief that the Federal Reserve may not be in a hurry to slash interest rates drastically.

What This Means for the Market

The contrasting paths of the Swiss Franc and the U.S. dollar reflect the different economic conditions in each country. While Switzerland grapples with lower inflation, the United States sees positive job growth.

As a result, investors are closely watching the decisions of the SNB and the Federal Reserve, as these could shape the markets market in the coming months.

USD/CHF Analysis – 9-October-2024

FxNews—The USD/CHF pair is in a bull market, trading above the critical $0.854 resistance. From a technical perspective, the uptrend should resume if the $0.854 resistance holds. In this scenario, the next bullish target could be $0.862. Furthermore, if bulls close and stabilize the price above $0.862, the path to $0.874 will likely be paved.

Conversely, a new bearish wave could emerge if the U.S. dollar falls below 0.854 against the Swiss Franc. If this scenario unfolds, the USD/CHF price could dip to the next support area, the 0.848 mark.

Comments are closed.