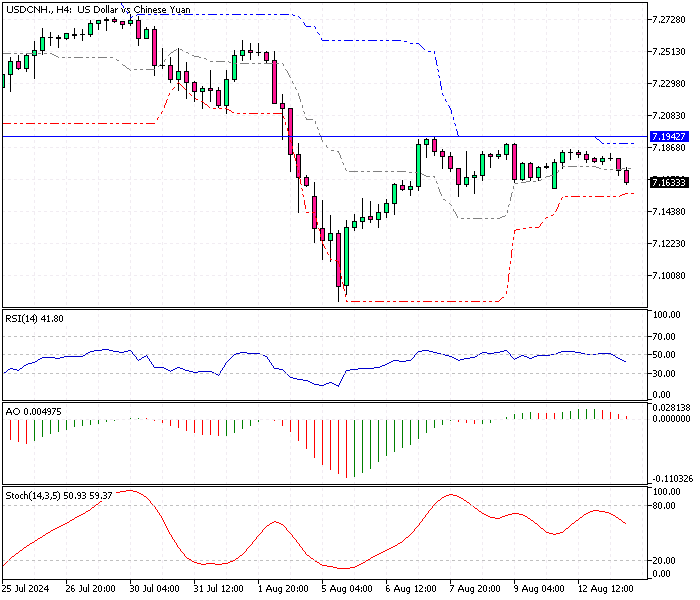

USDCNH Analysis – 13-August-2024

The offshore yuan steadied at $7.18 (USD/CNH) as traders prepared for important economic data from China. The focus is on several key indicators expected to be released soon, including the year-over-year growth in outstanding loans, new yuan loans, and the M2 money supply.

These figures will give insights into the health of China’s financial sector.

Key Economic Reports Set to Influence Markets

In addition to the financial data, investors are also anticipating reports on industrial production, retail sales, and the unemployment rate, which are scheduled for release later this week. These indicators will provide a broader view of China’s economic performance and consumer activity, helping traders assess the overall market direction.

Surprising Inflation Surge Raises Expectations

This week’s anticipation builds on last week’s surprising inflation data, which showed an unexpected jump in China’s annual inflation rate. The rate exceeded market predictions and reached its highest point since February, highlighting a continuous rise in domestic demand.

This uptick in inflation marks the sixth month in a row of increases, reflecting the impact of Beijing’s increased stimulus efforts to boost the economy.

Producer Prices Show Signs of Stabilization

While inflation is rising, China’s producer prices show a different trend. Annual producer deflation remained unchanged from the previous month but was better than expected. It represented the smallest deflation since January 2023, suggesting that the government’s various support measures are starting to affect stabilizing producer prices positively.

By monitoring these developments, traders and investors are looking to gauge the effectiveness of China’s economic policies and the potential direction of the yuan in the coming weeks.

Comments are closed.