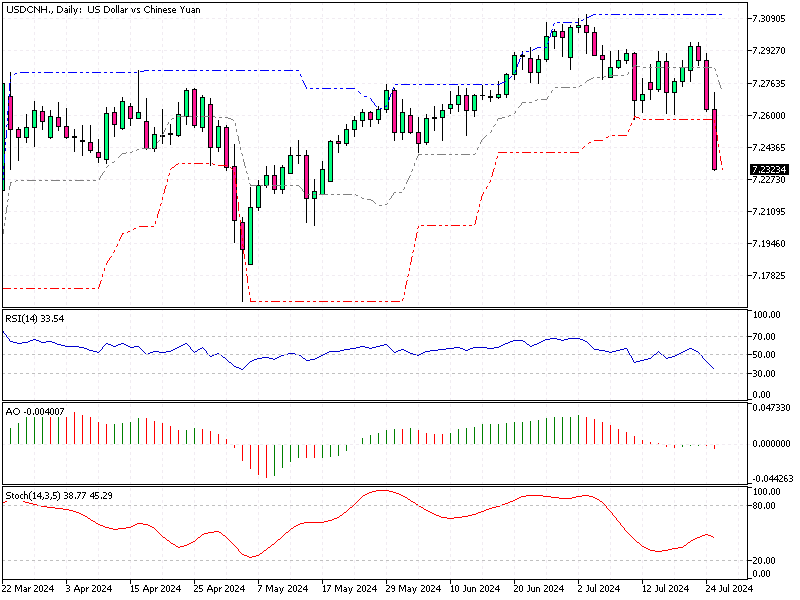

USDCNH Analysis – 25-July-2025

The offshore yuan has recently strengthened past 7.22 per dollar, marking its highest level in over two months. Despite several unexpected rate cuts by the People’s Bank of China (PBOC), this rise occurred. These significant developments indicate the complex interplay between domestic monetary policy and external currency dynamics.

- Read also: USD/JPY Fundamental Analysis – 25-July-2024

Unexpected Rate Cuts by the PBOC

On July 25th, the PBOC surprised by cutting the one-year medium-term lending facility (MLF) rate by 20 basis points, bringing it down to 2.3% from 2.5%. This was the largest reduction since April 2020.

Earlier in the same week, the central bank reduced the one-year loan prime rate (LPR) by ten basis points to 3.35%. This rate is crucial as it is the benchmark for most corporate and household loans.

Additionally, the five-year rate, which influences property mortgages, was also trimmed by ten basis points to 3.85%. These cuts aim to stimulate economic activity by making borrowing cheaper.

Impact on the Yuan and Market Expectations

The currency has appreciated despite concerns that lower interest rates might weaken the yuan. Experts believe the PBOC has various tools to manage the yuan’s value and prevent disorderly depreciation. One such tool is official guidance, which can help stabilize market expectations and maintain confidence in the currency.

External Factors Influencing the Yuan

Externally, the yuan’s recent appreciation is partly due to a weaker US dollar. The dollar’s decline has been influenced by the unwinding of short-yen carry trades, where investors borrow in yen to invest in higher-yielding assets.

As these trades are reversed, the demand for dollars decreases, leading to its depreciation.

USDCNH Analysis – 25-July-2025

The yuan’s strength is expected to continue as long as the PBOC effectively manages its monetary policy and external factors remain favorable. Investors should monitor the PBOC’s further actions and global economic trends to make informed decisions.

Understanding these dynamics will help navigate the complexities of the currency market and forecast future movements.

Comments are closed.