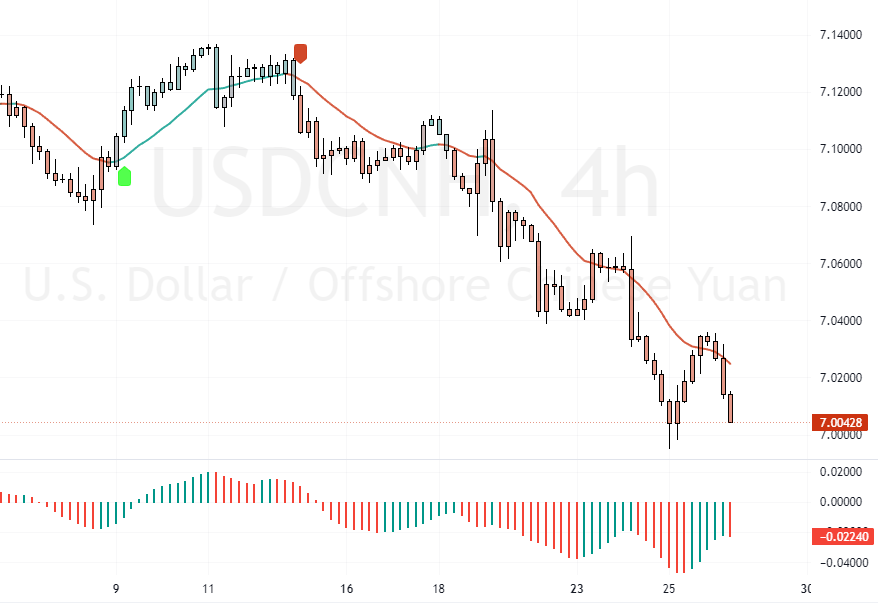

USDCNH Analysis – 26-September-2024

The USD/CNH currency pair recently hovered at approximately 7.0. This change comes as the market reacts to new monetary policies introduced by the People’s Bank of China (PBoC).

Policy Adjustment: Rate Cuts and Market Injection

In a move many anticipated, the PBoC lowered its one-year medium-term lending facility (MLF) rate to 2%, reducing 30 basis points. Governor Pan Gongsheng hinted at this decision just a day earlier.

Alongside the rate cut, the central bank infused an additional 300 billion yuan into the financial system to boost liquidity.

Strategic Stimulus: Aiming for Economic Goals

The PBoC’s recent actions are part of one of its most significant stimulus initiatives, revealed during an unusual briefing. These measures underscore Beijing’s dedication to hitting a 5% GDP growth target for 2024.

Other important actions included reducing the reserve requirement ratio by 50 basis points and lowering the seven-day reverse repo rate and benchmark loan prime rates by 20 to 25 basis points.

Looking Ahead: Future Expectations

Expectations are set for the PBoC to decrease mortgage rates by 50 basis points further and ease the down-payment requirements for purchasing second homes to just 15%, reflecting a strong push to encourage property investment and stabilize the market.

Conclusion: Strengthening Economic Stability

In conclusion, the People’s Bank of China actively deploys various monetary tools to ensure economic stability and growth. These recent moves provide immediate financial relief and demonstrate a strategic approach to meet set economic targets, potentially leading to more sustainable development in the near future.

Comments are closed.