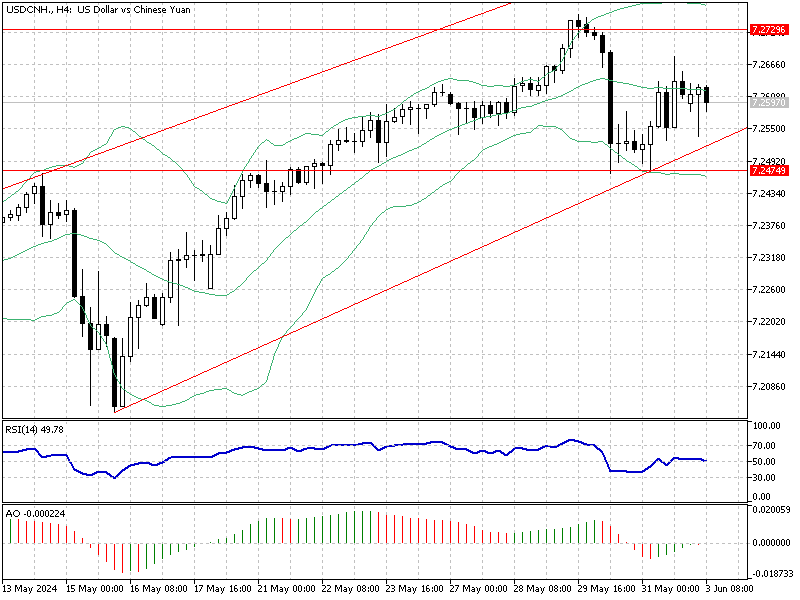

USDCNH Analysis – 3-June-2024

After an initial dip, the offshore yuan steadied at $7.26 (USD/CNH) as investors responded positively to encouraging economic signals from China. According to a recent private survey, China’s manufacturing activity in May increased for the seventh month, achieving its fastest growth in almost two years due to robust production and new orders.

Yuan Devaluation in Dividend Season

Additionally, there is a seasonal demand for foreign exchange from May to August. During this period, Chinese companies listed overseas typically need to purchase foreign currency to pay dividends to their international shareholders. This activity results in these companies selling the yuan, increasing its market supply, and consequently devaluing the yuan against other currencies, such as the US dollar.

Conclusion

Investors digest these developments and focus on upcoming economic reports, including new Chinese PMI and trade figures. These reports will be crucial in assessing China’s financial performance and future outlook. Keeping an eye on these indicators can help investors make more informed decisions and understand the broader economic trends influencing the yuan’s value.

Comments are closed.