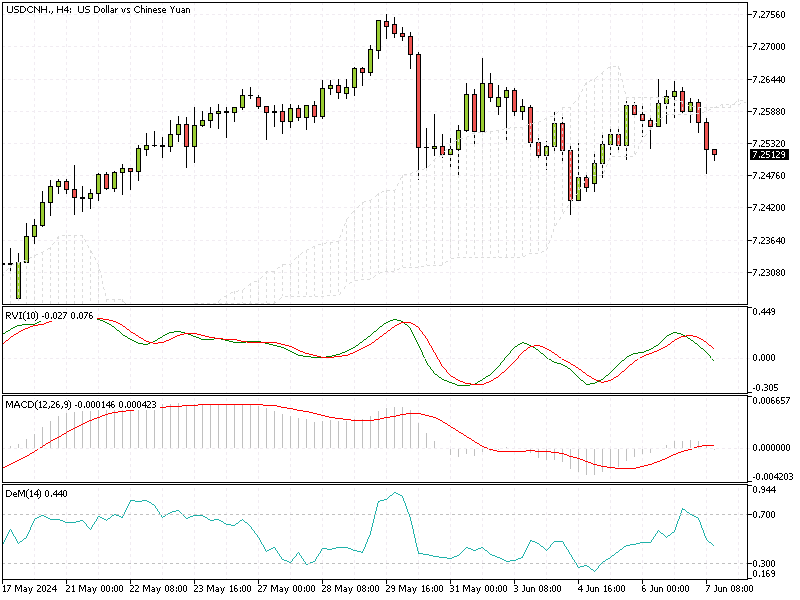

USDCNH Analysis – 7-June-2024

USD/CNH—The offshore yuan strengthened past 7.25 per dollar as investors reacted positively to recent economic data from China. This improvement is linked to a robust increase in Chinese exports for the second consecutive month in May, highlighting sustained global demand for Chinese goods.

This trend offers hope for the Chinese economy, which has been struggling with a prolonged downturn in its property sector while aiming for a stable recovery.

China’s Trade Growth Slows Down

In addition to exports, imports grew slower than expected, indicating cautious domestic demand. This mixed performance in trade data underscores the complexity of China’s economic situation, balancing between global demand and internal economic challenges.

GOP Targets Chinese Battery Makers

Meanwhile, a report from The Wall Street Journal mentioned that Republican lawmakers in the U.S. are pushing for a ban on Chinese battery companies connected to major automakers like Ford and Volkswagen. They cite allegations of forced labor in these companies’ supply chains, raising concerns about ethical practices and prompting calls for stricter trade restrictions.

U.S. Jobs Report Set to Impact Markets

Investors are also eagerly awaiting the upcoming U.S. monthly jobs report, scheduled for later today. This report is crucial as it provides insights into the health of the U.S. labor market, which can significantly influence global economic trends and investor strategies.

Comments are closed.