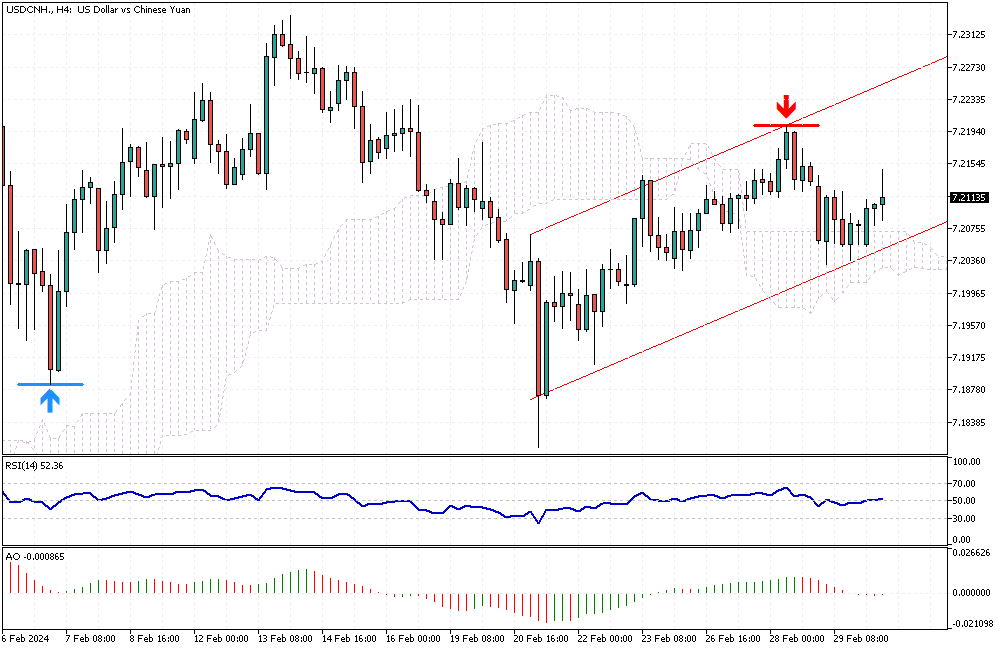

USDCNH Analysis – March-1-2024

USDCNH Analysis – The offshore yuan has declined, approaching 7.21 against the dollar. This movement is a reaction to the latest updates on private sector activities in China. Reports reveal a sustained decline in manufacturing for the fifth consecutive month as of February. On the other hand, the services sector is seeing an upturn, reaching a peak not seen in the last five months.

Additionally, contrary to expectations, a private survey indicated a significant improvement in Chinese factory operations the previous month.

USDCNH Analysis: Anticipation of Policy Announcements

Attention is now turning towards the upcoming National People’s Congress. China’s leaders will present the economic objectives and main strategies for the coming year at this event. This is critical as investors and analysts will gain insights into the government’s plans to address various economic challenges. The yuan is experiencing fluctuations, partly due to anticipations surrounding this significant political conference.

China’s Response to Economic Slowdown

China’s economic recovery is progressing slowly, prompting actions from the People’s Bank of China. The central bank boldly reduced the five-year loan prime rate by 25 basis points, bringing it down to 3.95%. This is the most significant cut since the rate’s introduction in 2019. Furthermore, to inject more liquidity into the economy, the PBOC cut the reserve requirements for banks by 50 basis points this February.

These measures are part of broader efforts to stimulate economic activity and counteract the sluggish recovery pace.

Comments are closed.