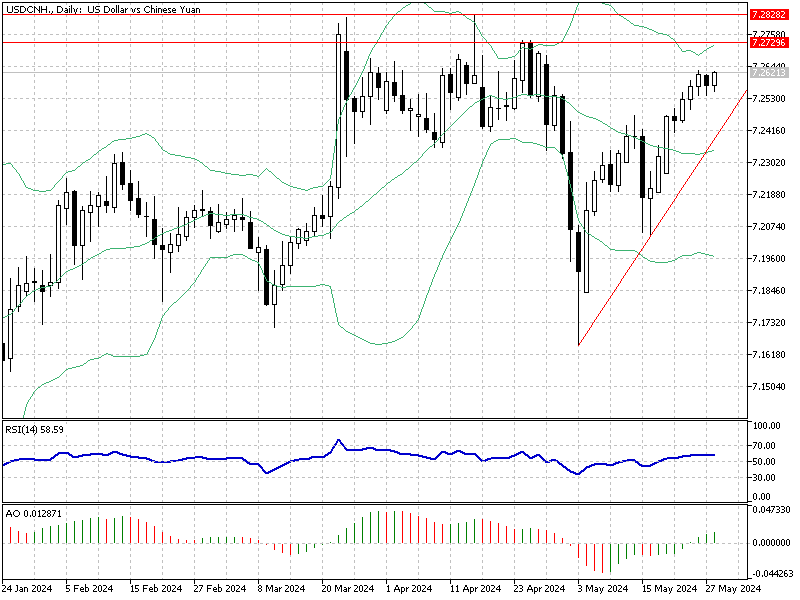

USDCNH Analysis – May-28-2024

USD/CNH Analysis—The offshore yuan steadied at 7.259 per dollar, as traders remained cautious ahead of key inflation data from major economies this week. This data is crucial for understanding the path for global interest rates in the short term.

USDCNH Analysis – May-28-2024

The primary focus for the market will be the US core personal consumption expenditures (PCE) price index report. This report, the Federal Reserve’s preferred measure of inflation, is expected to remain stable every month.

Domestically, Maybank noted that yuan sentiment could improve sustainably if China successfully stabilizes its housing market and boosts private consumption. Recently, Shanghai has reduced the minimum downpayment ratios for home buyers and eased some restrictions on home purchases. This aligns with a nationwide initiative to stabilize the market.

Impact of Upcoming Chinese PMI Data

In addition to the housing market measures, markets are also looking ahead to the upcoming Chinese PMI data. This data will help assess the health of the world’s second-largest economy in the coming days. (Source Bloomberg)

Conclusion

Forex traders should keep a close eye on both the US PCE report and the Chinese economic signals. These factors will provide crucial insights into the future movements of the yuan and other currencies, helping traders make informed decisions in the dynamic forex market.

Comments are closed.