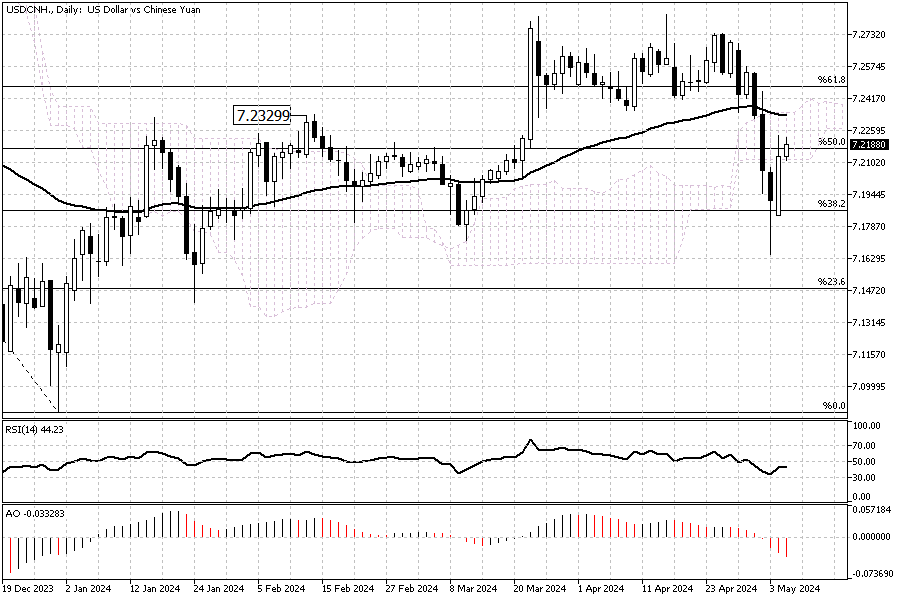

USDCNH – China Central Bank Ensures Yuan Stability

The offshore yuan has stabilized around 7.22 per dollar (USD/CNH), reflecting a calm in the currency markets amidst a stable US dollar. Investors closely monitor statements from central bank officials, aiming to discern the Federal Reserve’s next moves regarding monetary policy.

This scrutiny follows remarks by New York Fed President John Williams, who pointed out that future interest rate adjustments would depend on incoming economic data.

Central Bank Insights and Investor Sentiment

Further comments from Richmond Fed President Thomas Barkin have injected a dose of optimism into the markets. Barkin’s confidence that inflation will return to the Fed’s 2% target suggests that the current restrictive measures are effective. This sentiment is bolstered by recent soft US labor data, which has led investors to anticipate a possible reduction in interest rates.

According to the CME’s FedWatch Tool, market predictions now show a 64% probability of an interest rate cut by the Federal Reserve in September.

China Central Bank Ensures Yuan Stability

On the other side of the Pacific, the People’s Bank of China is taking measures to ensure the stability of its currency. By setting the yuan’s midpoint rate at 7.0994 per dollar, which is higher than market expectations, the Chinese central bank demonstrates a strong commitment to maintaining currency stability.

This move is critical for traders and investors, reflecting a controlled approach to the yuan amidst global economic uncertainties.

Comments are closed.