USDCNH – PBOC Influence on Yuan

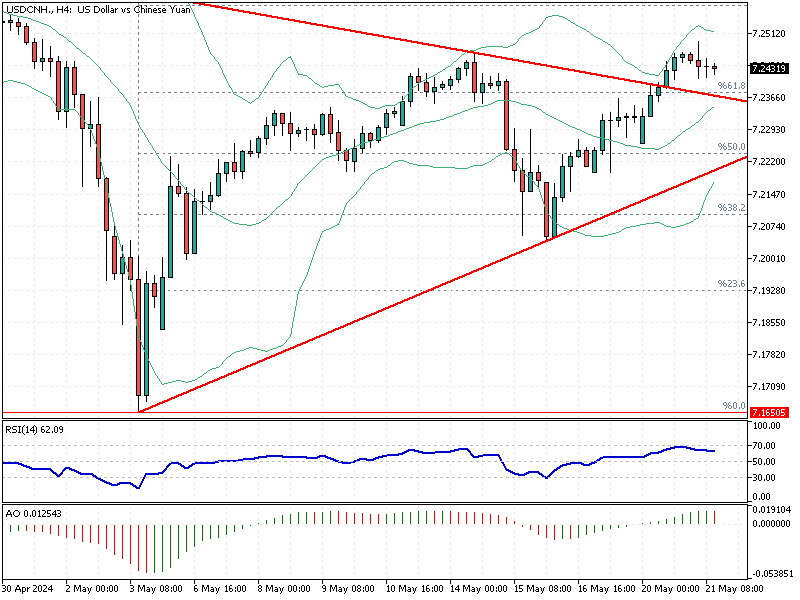

The offshore yuan stabilized at 7.24 per dollar (USD/CNH) after experiencing a three-week low earlier in the session. This came after the People’s Bank of China (PBOC) set the official guidance at 7.1069 per dollar, marking its weakest level since February 28.

USDCNH – PBOC Influence on Yuan

Bloomberg—The PBOC’s decision to set the official guidance at a weaker level played a significant role in the recent movement of offshore yuan. By adjusting the guidance rate, the PBOC influences the yuan’s value in the market. This move suggests responding to various economic pressures, including capital outflows and external market conditions.

Impact of Capital Outflow and Strong US Dollar

The yuan’s depreciation can also be attributed to worsening capital outflow. Investors are moving their funds out of China, leading to further pressure on the yuan. Additionally, the yuan faced challenges from a stronger US dollar.

Several Federal Reserve officials have advocated for continued policy caution, strengthening the dollar. This comes despite recent data showing an easing in consumer prices in April after three months of unexpected inflation increases.

Anticipation of FOMC Minutes

Traders are now eagerly anticipating the release of the Federal Open Market Committee (FOMC) minutes. These minutes will provide deeper insights into the Federal Reserve’s policy direction, which can significantly impact the forex market. Understanding the Fed’s stance will help traders make more informed decisions regarding the yuan and other currencies.

Comments are closed.