USDJPY – April Inflation Impact Yen

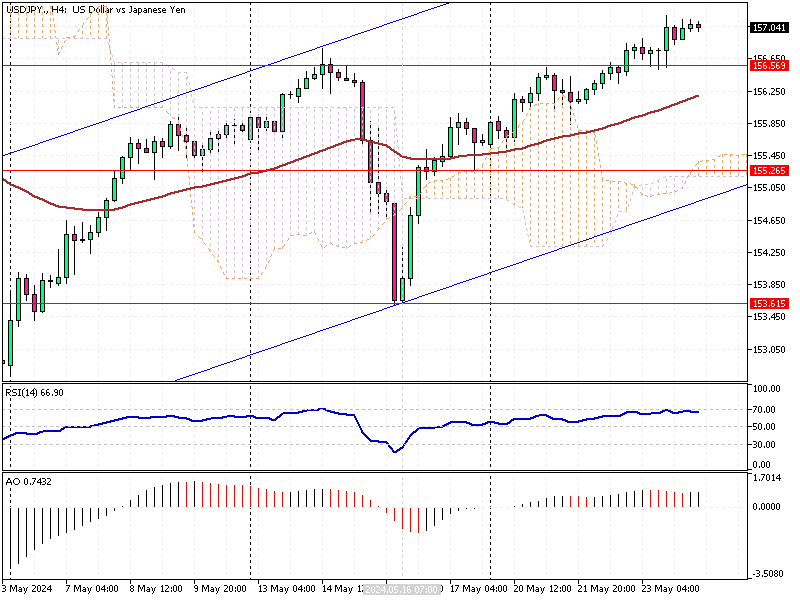

The Japanese yen hovered around $157 (USD/JPY) and is set to lose nearly 1% this week. Investors are responding to Japan’s latest inflation data, which showed a continued slowdown in April.

The core inflation rate dipped to 2.2%, down from 2.6% in March, primarily due to milder food inflation. The headline rate also fell to 2.5% from 2.7%, marking the second consecutive month of decline.

USDJPY – April Inflation Impact Yen

Bloomberg—The yen also faced pressure from a strengthening US dollar. Stronger-than-expected economic data from the US raised concerns that the Federal Reserve might delay cutting interest rates. The latest Federal Open Market Committee (FOMC) minutes revealed that policymakers still worry about persistent inflation. Some members are even open to tightening policy further if inflation rises.

In contrast, market participants believe the Bank of Japan (BOJ) will slowly normalize its monetary policy and raise rates. This cautious stance by the BOJ makes the yen carry trade attractive, where traders borrow yen at low interest rates to invest in higher-yielding currencies.

Implications for Forex Traders

These developments highlight the importance of forex traders monitoring inflation data and central bank policies. Understanding these economic indicators can help traders make more informed decisions and anticipate market movements. The yen’s recent performance underscores how interconnected global economic data can influence currency values.

By staying updated on these trends, traders can better navigate the forex market and optimize their trading strategies.

Comments are closed.