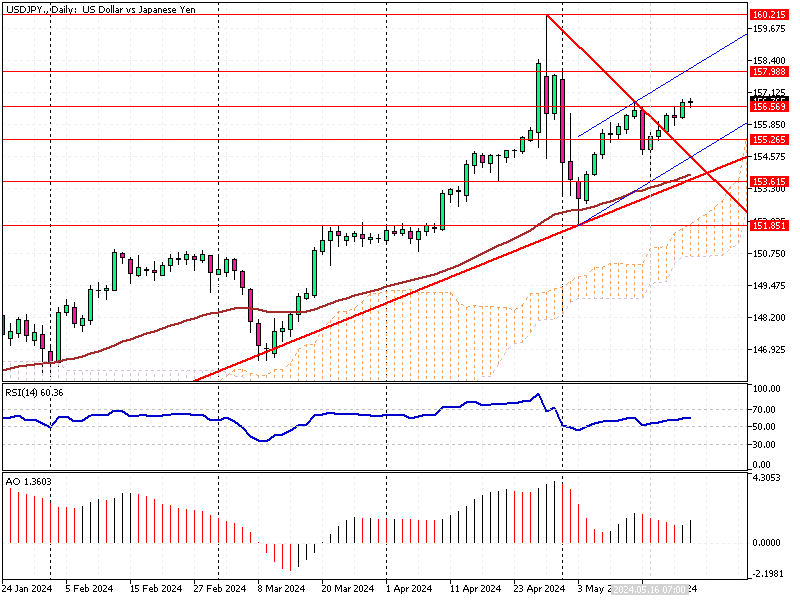

USDJPY – Bank of Japan Slow Approach

The Japanese yen has depreciated to around $157 (USD/JPY), marking its lowest level in three weeks. This decline is mainly due to a strong dollar, which gained momentum after the latest Federal Reserve policy meeting minutes were released.

The minutes highlighted concerns about persistent inflation and showed some members’ willingness to tighten policy further if inflation rises again.

Federal Reserve’s Hawkish Signals

The Federal Reserve’s recent meeting minutes revealed that some members are ready to implement more policy tightening if inflation rises. This hawkish stance has strengthened the dollar, putting pressure on the yen. This suggests a possible continuation of dollar strength for forex traders, which could further impact the yen.

USDJPY – Bank of Japan Slow Approach

In contrast, the Bank of Japan (BOJ) is expected to normalize its monetary policy and slowly raise interest rates. This slow approach makes the yen carry trade appealing, as investors borrow in yen to invest in higher-yielding currencies. The market’s expectation of the BOJ’s cautious stance is a key factor in the yen’s current weakness.

Japanese Firms’ Preferences

A Reuters survey revealed that 37% of Japanese firms want the central bank to hike rates again to counteract the yen’s decline. Meanwhile, 34% of respondents prefer government intervention in the forex market. This split in opinion highlights the ongoing debate about the best approach to support the yen and stabilize the economy.

Economic Growth Insights

Despite the yen’s depreciation, Japan’s economic data shows positive signs. Private sector growth reached a nine-month high in May, with manufacturing activity returning to expansion. This growth indicates underlying strength in the Japanese economy, which could influence future monetary policy decisions.

Conclusion

For forex traders and investors, the current dynamics between the yen and the dollar are crucial. Understanding the Federal Reserve’s hawkish stance, the BOJ’s cautious approach and Japanese firms’ mixed preferences can help make informed trading decisions. Keep an eye on further economic data and policy signals to navigate the forex market effectively.

Comments are closed.