USDJPY Consolidates as BoJ Faces Economic Pressures

On Wednesday, the Japanese yen steadied around 148 per dollar after hitting its lowest level seven weeks earlier this week. This stabilization came as investors continued to evaluate potential changes in the Bank of Japan’s (BoJ) monetary policy.

In its latest quarterly report, the BoJ highlighted that price and wage increases were becoming more widespread nationwide. However, it also noted concerns from smaller businesses about their shrinking profit margins.

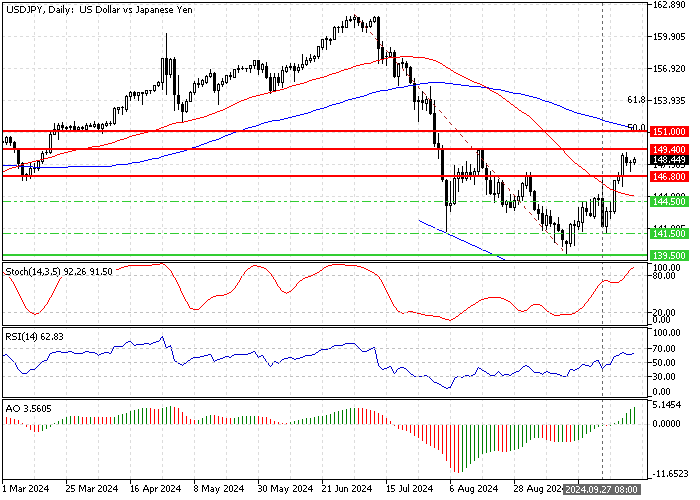

The USD/JPY chart below shows the current price, 148.4, and critical levels.

USDJPY Fundamental Analysis – 9-October-2024

Recent economic data pointed to some struggles for Japan. In August, real wages in the country decreased by 0.6% following two months of growth, signaling a possible slowdown in income gains.

At the same time, household spending dropped by 1.9%, reflecting cautious consumer behavior amid economic uncertainties. These figures suggest that while prices may rise, consumers and businesses feel the pinch in other areas.

Government’s Cautious Stance on Rate Hikes

The yen faced additional pressure as Japan’s new Prime Minister, Shigeru Ishiba, and his economy minister, Ryosei Akazawa, carefully approached further interest rate hikes.

They emphasized the need to proceed with caution due to the current economic climate, highlighting the importance of maintaining stability rather than rushing into policy changes. This cautious approach aimed to support the economy while balancing inflationary pressures.

US Jobs Data Adds Pressure to the Yen

Robust job numbers further influenced the yen’s decline in the United States. A stronger-than-expected jobs report released last Friday led markets to believe the Federal Reserve might not proceed with a significant 50 basis point rate cut in November.

This expectation shift strengthened the U.S. dollar against the yen, adding more pressure on the Japanese currency.

USDJPY Analysis – 9-October-2024

FxNews—The USD/JPY currency pair is consolidating in a narrow range, above the 146.8 support and below the 149.4 resistance. The primary trend is bullish because the U.S. dollar trades above the 50- and 100-simple moving averages against the Japanese yen. Furthermore, the technical indicators show bearish momentum in their records.

- The Stochastic oscillator declines as the Awesome Oscillator bars turn red and approach the signal line from above.

- On the other hand, the Relative strength index gives a mixed signal, with its value above the median line and rising.

From a technical standpoint, the 149.4 is a critical resistance level that has managed to hold the USD/JPY price to fly further. Hence, bulls must close and stabilize at a price above 149.4 for the uptrend to resume. If this scenario unfolds, the next bullish target could be the 151.0 resistance area, backed by the daily 100-SMA.

Conversely, a dip below the immediate support at 146.8 could trigger a new bearish wave. In this scenario, the recent bearish momentum can spread to the 144.5 supply zone, followed by 141.5.

Comments are closed.