USDJPY Fundamental Analysis – 16-July-2024

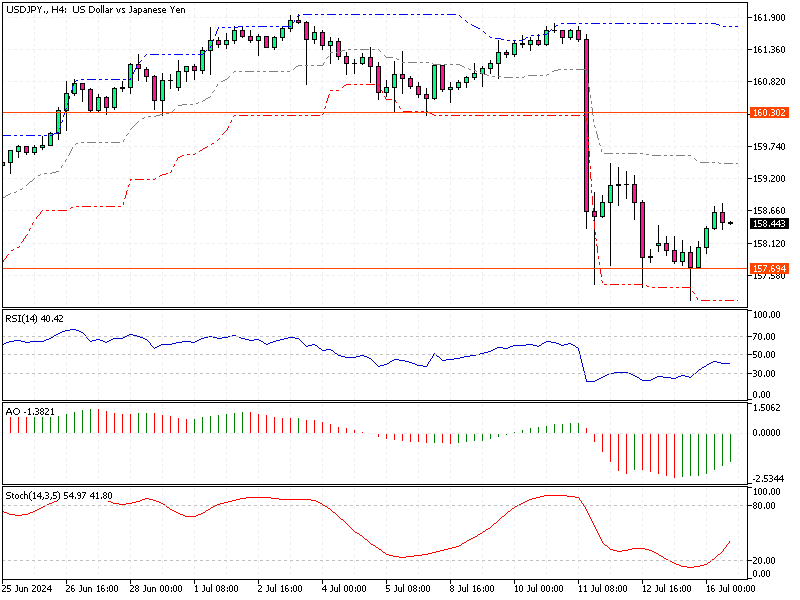

The Japanese yen recently depreciated beyond $158.4 (USD/JPY), reversing some of its gains last week. This shift occurred as the US dollar found support from safe-haven bids following an attempted assassination of former US President Donald Trump.

These developments occurred despite Federal Reserve Chair Jerome Powell indicating that recent data adds confidence that inflation is returning to the 2% target, which bolstered bets for potential US interest rate cuts.

Japan Intervenes as Yen Hits 157.36

Last week, the yen rallied, reaching a high of 157.36 per dollar, following cooler-than-expected US inflation figures. This rally was supported by Bank of Japan (BOJ) data suggesting the Japanese government might have spent up to 3.57 trillion yen on Thursday to support its currency.

This intervention by the Japanese government aimed to stabilize the yen amidst fluctuating market conditions. Traders eagerly await fresh money market data to determine if Tokyo intervened again on Friday.

Japan’s Upcoming Policy Meeting Effects

Looking forward, traders and investors are closely watching the monetary policy front. The Bank of Japan is expected to announce its bond purchase tapering plans and potentially raise interest rates again at its upcoming policy meeting later this month. This anticipated move could significantly impact the yen’s value and overall market dynamics.

USDJPY Fundamental Analysis – 16-July-2024

The yen’s depreciation of the past 158.5 per dollar reflects a complex interplay of global and domestic factors. Safe-haven bids for the US dollar increased following the dramatic news regarding former President Trump, highlighting how political events can influence currency markets.

Meanwhile, the Federal Reserve’s confidence in returning inflation to its 2% target suggests a potential easing of US monetary policy, which could affect global currency valuations.

In Japan, the government’s intervention to prop up the yen indicates a proactive approach to managing its currency amidst global uncertainties. The upcoming BOJ policy meeting will be critical, as any decisions on bond purchases and interest rates will provide further direction for the yen.

Final Word

These developments underscore the importance of informing market participants about global and domestic economic data. Understanding the factors driving currency movements can help investors make more informed decisions and better anticipate future market trends. As always, vigilance and adaptability remain key to navigating the complex world of forex markets.

Comments are closed.