USDJPY Fundamental Analysis – 25-June-2024

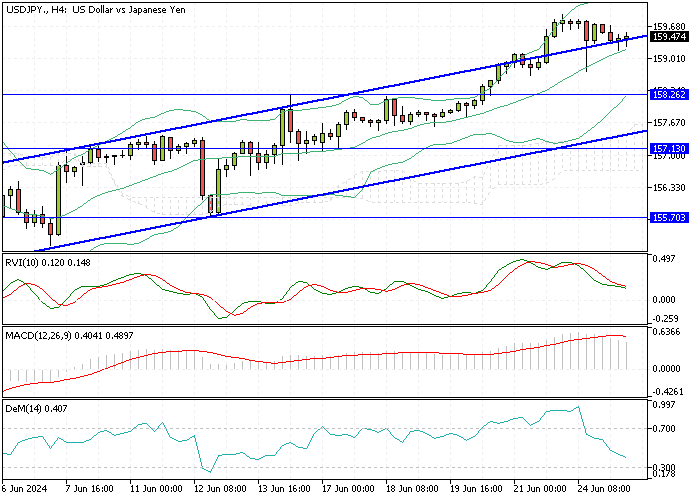

USD/JPY—The Japanese yen has stabilized at around 159.3 per dollar after nearing the critical 160 mark, which previously prompted intervention by Japanese authorities. Masato Kanda, Japan’s top currency diplomat, emphasized that Japan is prepared to act against excessive yen volatility whenever necessary, highlighting the need for currency movements to remain stable and reflect economic fundamentals.

Yen Falls as BOJ Debates Rate Hike

The yen’s recent decline intensified following the Bank of Japan’s (BOJ) June meeting summary, revealing a divided stance among policymakers regarding the next interest rate hike. One member advocated for prompt action due to rising inflation risks, while others preferred a cautious approach, awaiting more data.

These discussions occur as the BOJ maintains its extensive bond purchases, deferring any reduction until its next policy meeting in July when it plans to unveil a strategy for scaling back its bond-buying program.

USDJPY Fundamental Analysis – 25-June-2024

The Japanese yen’s recent decline is driven by uncertainty following the Bank of Japan’s (BOJ) June meeting. The meeting summary revealed a split among policymakers about the timing of the next interest rate hike.

One member urged immediate action due to escalating inflation risks, while others advocated for a more cautious approach, preferring to wait for additional economic data. This divergence has amplified market concerns about the BOJ’s policy direction.

Compounding the uncertainty, the BOJ continues its extensive bond purchases, postponing any reduction until its next policy meeting in July.

The BOJ will present a strategy for scaling back its bond-buying program at this meeting. The market is keenly anticipating this plan, as it will provide crucial insights into the BOJ’s future monetary policy stance. Until then, the yen may remain under pressure, reflecting investor apprehensions about Japan’s economic stability and policy trajectory.

Comments are closed.