USDJPY Fundamental Analysis – 4-June-2024

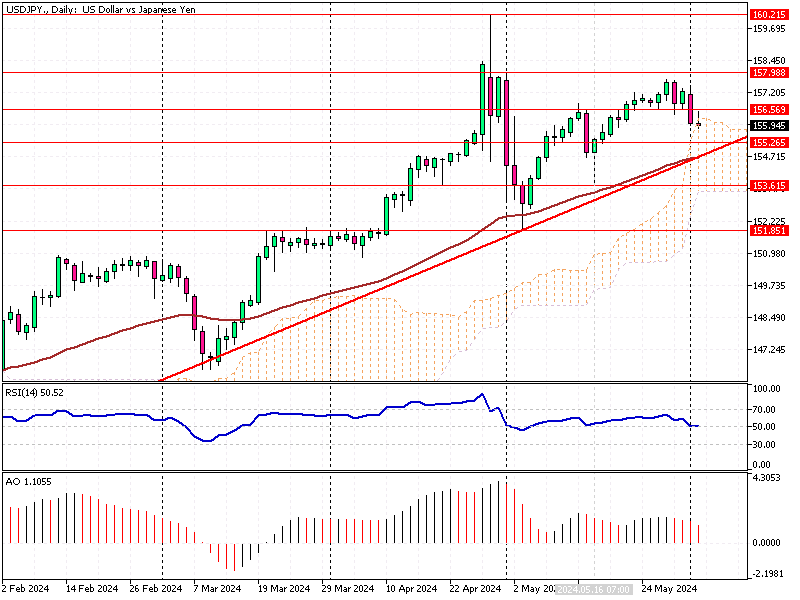

The Japanese yen has strengthened to around 155.9 per dollar (USD/JPY), marking its highest level in two weeks. This change comes as the US dollar weakened due to poor US manufacturing data, which may lead to interest rate cuts by the Federal Reserve.

Japan Monetary Policy and Wage Trends

In Japan, all eyes are on the upcoming wage and household spending data, which could impact the country’s monetary policy. Recently, Bank of Japan board member Seiji Adachi mentioned the possibility of raising interest rates if the yen’s rapid decline causes more inflation. Similarly, BOJ Deputy Governor Shinichi Uchida expressed optimism that Japan’s long fight against deflation might end, with wages expected to continue rising.

Tokyo’s latest core inflation data showed an increase to 1.9% in May from 1.6% in April. However, this rate is still below the BOJ’s target of 2%.

Summary

Understanding these economic indicators is crucial for making informed financial decisions. A stronger yen and rising wages could shift Japan’s economic landscape, potentially leading to changes in interest rates and investment opportunities. Staying updated on these developments will help investors and consumers navigate the evolving financial environment.

Comments are closed.