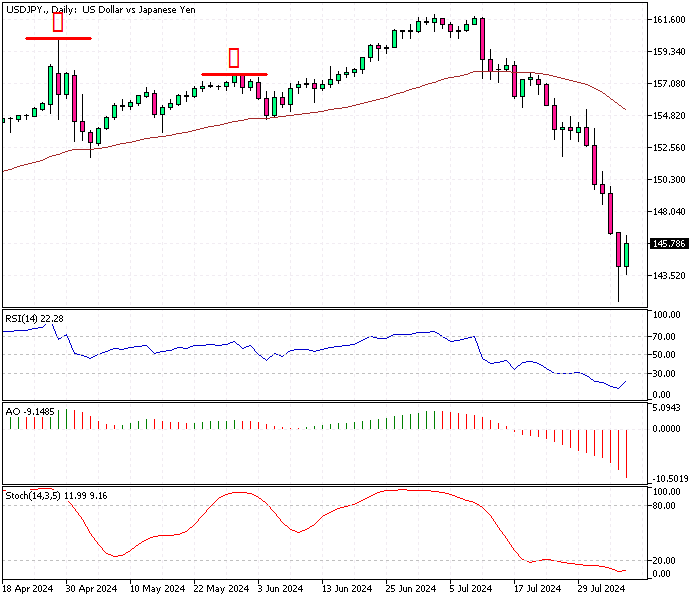

USDJPY Fundamental Analysis – 6-August-2024

The Japanese yen has been declining towards $145 (USD/JPY), moving away from its seven-month highs. This shift is due to the slowdown in the unwinding of popular carry trades and investors analyzing the different monetary policies between Japan and the US. Earlier this week, the yen reached a high of 141.69 per dollar.

This rise was driven by expectations that the Bank of Japan (BOJ) would increase interest rates in the coming months. At the same time, concerns about a potential US recession led markets to anticipate significant interest rate cuts by the Federal Reserve.

- Also read: NZDUSD Fundamental Analysis – 6-August-2024

Last week, the BOJ raised its policy rate to 0.25% and indicated it might raise rates further if the economy continues to perform well. Markets are predicting two more rate hikes within the fiscal year ending in March 2025, with the next expected in December.

Additionally, the BOJ announced a plan to reduce its monthly bond purchases by half over the next couple of years. Meanwhile, data revealed that Japanese authorities spent 5.53 trillion yen in July to support the currency through intervention.

Comments are closed.