USDJPY Fundamental Analysis – March-6-2024

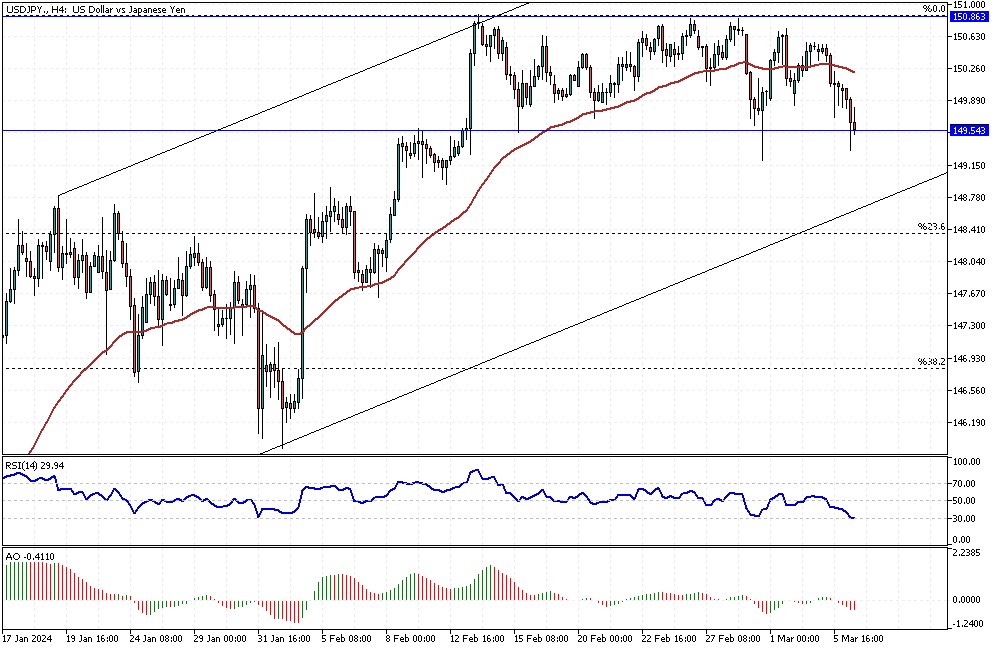

The Japanese yen has increased in value, over 150 against the dollar. This is because the US dollar is getting weaker. The weakening is due to poor US economic reports, leading people to think the Federal Reserve will lower interest rates soon. Everyone is waiting for Jerome Powell, the Fed Chair, to speak to the US Congress. They hope he will give hints about future financial policies.

Inflation Trends in Tokyo Impact on Monetary Policy

In Japan, the cost of living in Tokyo is going up. The core inflation rate rose to 2.5% in February, up from 1.8% in January. This rate measures the cost of goods excluding fresh food. It’s now above the Bank of Japan’s target of 2%. This increase is significant because it might predict what will happen with prices all over Japan.

Bank of Japan’s Monetary Strategy

A Bank of Japan official, Hajime Takata, suggested it’s time to talk about making money policies stricter. This could mean ending negative interest rates and stopping control over how much interest bonds pay. But, the head of the Bank of Japan, Kazuo Ueda, thinks it’s too soon to be sure they’ve consistently hit their 2% price increase goal. He wants to wait for more information before making any decisions.

Comments are closed.