USDJPY Fundamental Analysis – 17-September-2024

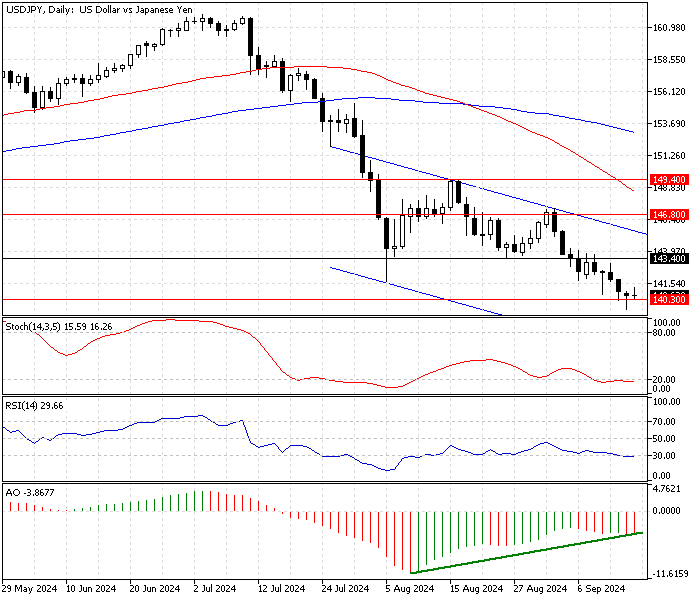

On Tuesday, the Japanese yen traded around $140.3 (USD/JPY), close to its highest level in 13 months. This movement comes as investors prepare for key monetary policy decisions from Japan and the US this week.

Bank of Japan’s Expected Moves

The Bank of Japan (BOJ) is expected to keep interest rates the same on Friday. However, they might hint at future rate hikes. Markets believe the BOJ will raise rates again in December, though an October hike is still possible.

Anticipation of US Rate Cut

Meanwhile, on Wednesday, the US Federal Reserve will announce its first rate cut in four years. Many believe there’s a two-thirds chance of a significant 0.50% cut.

Impact of Currency Fluctuations

Japan’s Finance Minister, Shunichi Suzuki, mentioned on Tuesday that changes in foreign exchange rates have good and bad effects on the economy. He emphasized that rapid changes are not desirable.

Conclusion

In summary, the Japanese yen is strong as investors await important policy decisions from Japan and the US. The BOJ will likely keep rates steady but may signal future hikes.

The US Federal Reserve is expected to cut rates, which could impact global markets. Currency fluctuations have mixed economic effects, and sudden changes are not preferred.

Comments are closed.