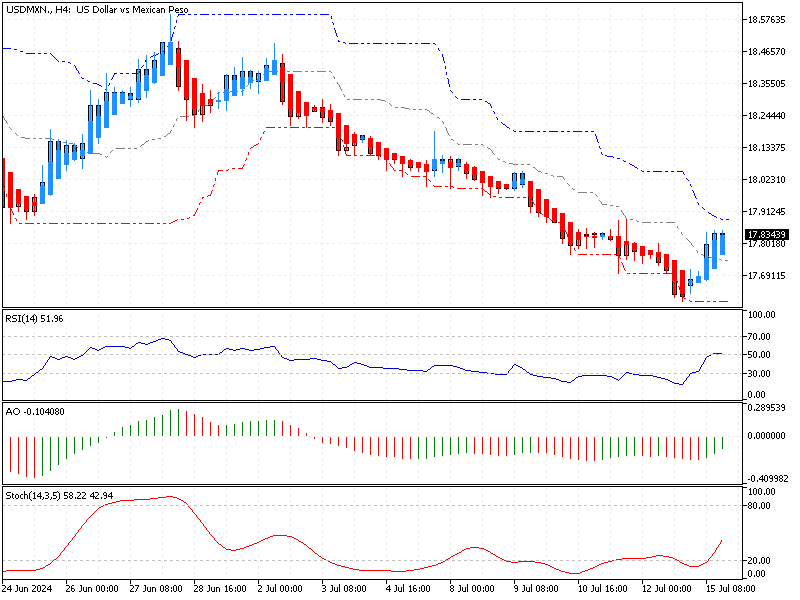

USDMXN Analysis – 15-July-2024

The Mexican peso has shown significant strength, recently moving past $17.83 (USD/MXN). This rebound marks a substantial recovery from its fifteen-month low of 18.75 on June 12th. The factors driving this recovery are multifaceted, involving domestic and international economic influences.

US Dollar Weakness Fuels Peso Gains

One key factor is the recent weakness of the US dollar. This decline in the dollar’s value is mainly due to expectations that the Federal Reserve might adopt a more dovish stance following softer-than-expected inflation data in the United States. A dovish Federal Reserve typically indicates slower or fewer interest rate hikes, which can weaken the dollar and make other currencies, like the peso, more attractive.

Mexico’s Inflation Hits One-Year High

Domestically, the latest minutes from the Bank of Mexico (Banxico) have provided additional insights into the peso’s performance. Policymakers at Banxico have expressed concerns about ongoing inflation challenges. In June, Mexico’s annual headline inflation rose to 4.98%, hitting a one-year high and exceeding market forecasts. This surge in inflation underscores the persistent price pressures within the economy.

Mexico’s Consumer Confidence Soars

Additionally, consumer confidence in Mexico has climbed to its highest level since February 2019, reaching 47.5. This boost in confidence suggests that consumers are more optimistic about their financial situations and the overall economy. Such sentiment can support economic stability and growth, which in turn can bolster the national currency.

USDMXN Analysis – 15-July-2024

In response to these economic conditions, Banxico has emphasized the need for a cautious approach to monetary policy. The rise in inflation and heightened consumer confidence give Banxico strong reasons to maintain firm borrowing costs. By keeping interest rates high, Banxico aims to control inflation and stabilize the economy, which can further support the peso.

Looking ahead, the future strength of the Mexican peso will likely depend on several factors. Internationally, the Federal Reserve’s actions and the performance of the US dollar will play crucial roles. Domestically, Banxico’s monetary policies and Mexico’s inflation trends will be pivotal. Investors and analysts will closely monitor these factors to gauge the peso’s future trajectory.

Final Word

In summary, the Mexican peso’s recent strength results from external influences, such as the weaker US dollar, and internal factors, like rising inflation and consumer confidence in Mexico. Understanding these dynamics is crucial for making informed financial decisions and anticipating future market movements.

Comments are closed.