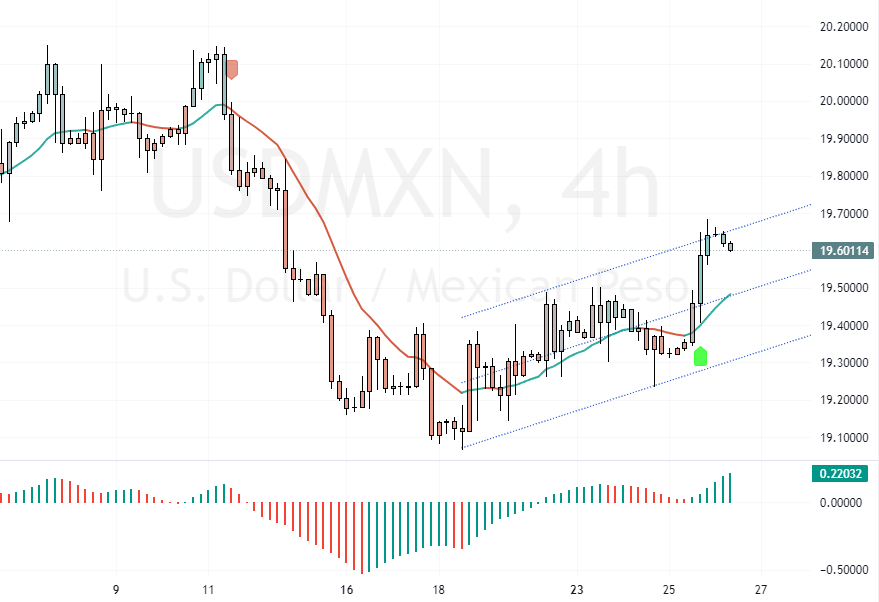

USDMXN Analysis – 26-September-2024

The Mexican peso has declined, falling to $19.55 (USD/MXN) from a four-week peak of 19.12 recorded on September 17th. This shift comes as market participants await an important monetary policy announcement from the Bank of Mexico on Thursday. Concurrently, the US dollar’s strength continues to exert pressure on the peso.

Anticipations and Speculations Around Interest Rates

Financial experts are predominantly expecting a minor rate cut from the upcoming decision. However, discussions are leaning towards a more significant cut of 50 basis points.

This speculation is fueled by a more significant than forecasted deceleration in inflation rates. Recent figures show that mid-September annual headline inflation cooled to 4.66%, and core inflation, which excludes volatile items, slowed to 3.95%, marking the lowest rate since February 2021.

External Influences on the Peso

Another factor contributing to the peso’s recent weakness is the diminishing impact of economic stimulus measures from the People’s Bank of China.

These measures had previously bolstered emerging market currencies by enhancing the attractiveness of carry trades, mainly benefiting the peso. As the effects of these stimuli wane, currencies like the peso face downward pressure.

Conclusion

The Mexican peso is currently under pressure as it experiences a drop, influenced by the strength of the US dollar and anticipation of Mexico’s central bank decisions.

The decrease is also linked to the fading effects of financial stimuli from China, which had earlier supported the peso. As investors and analysts watch these developments closely, the peso’s value continues to adjust to these global economic dynamics.

Comments are closed.