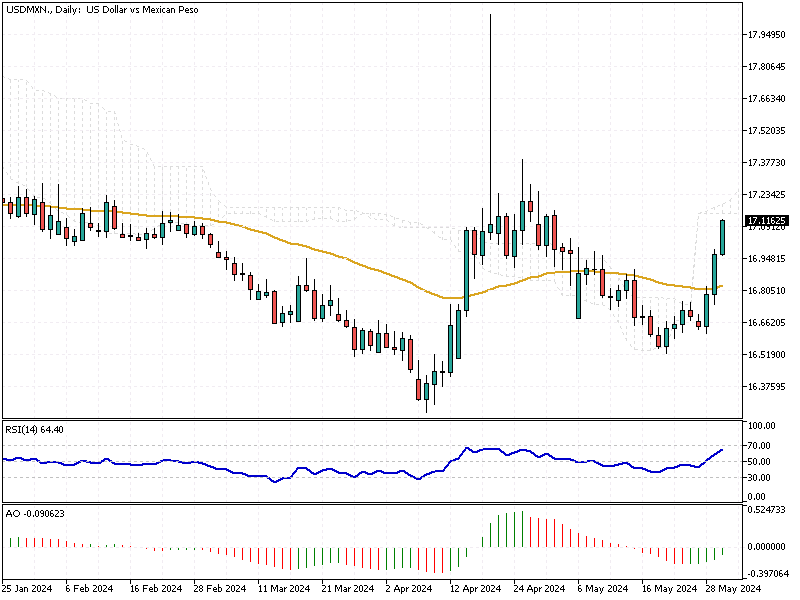

USDMXN Analysis – May-30-2024

In late May, the Mexican peso weakened beyond 16.69 per USD (USD/MXN), hitting a low not seen in over three weeks. This decline is attributed to low-risk sentiment and a strengthening US dollar. The shift in investor behavior is mainly due to caution ahead of Mexico’s upcoming general elections, leading many to reduce their exposure to the peso.

USDMXN Analysis – May-30-2024

Adding to the economic context, a recent Citibanamex poll revealed key expectations from economists. They anticipate that Mexico’s central bank, Banxico, will lower interest rates from 11% to 10.75% on June 27. This prediction is based on median estimates showing headline inflation at 4.21% and core inflation at 4.07% for 2024, suggesting that price pressures might be easing.

This Thursday’s release of Mexican unemployment figures will be crucial. These numbers could offer further insight into Banxico’s next steps regarding interest rates. The US dollar has strengthened, buoyed by expectations of prolonged higher interest rates and potential future rate hikes.

Conclusion

As the peso struggles and the dollar rallies, monitoring these economic indicators will be essential for making informed financial decisions. Understanding these trends can help navigate the uncertainties of the current economic landscape, providing a clearer picture of what might lie ahead for both the Mexican and global economies.

Comments are closed.