USDCHF – SNB Warns of Inflation Shocks

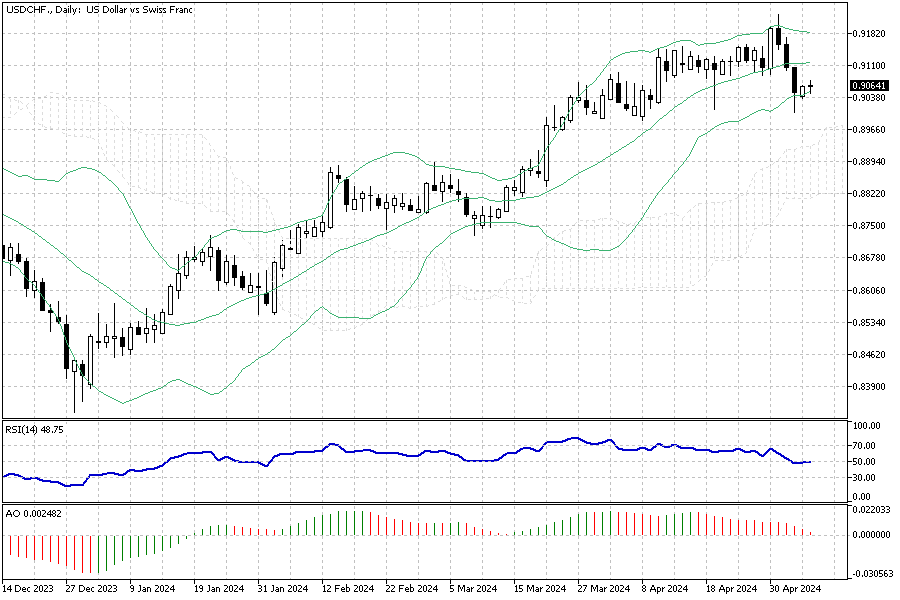

The Swiss franc recently rallied to 0.91 per USD, recovering from a seven-month trough of 0.92 on May 1st. This movement comes after unexpected inflation figures emerged, prompting financial markets to reevaluate the possibility of further monetary easing by the Swiss National Bank (SNB).

In April, inflation escalated to 1.4%, up from a low of 1% in the previous month and surpassing the forecasts of 1.1%. This price spike, significantly above expectations, has led to a cautious stance towards the Swiss currency’s future.

SNB Warns of Inflation Shocks

With rising geopolitical tensions and a less stringent policy on the franc, the SNB has acknowledged the economy’s susceptibility to shocks. This acknowledgment comes when foreign currency reserves have risen for four consecutive months after hitting a seven-year low last November.

Despite this build-up, the swift increase in consumer prices and worries about potential secondary inflationary effects have tempered predictions of a June rate cut by the SNB.

Market Reactions and Outlook

The Swiss franc’s strength is also bolstered by a weakening U.S. dollar, which followed the Federal Reserve’s latest decision where it opted not to project an overly aggressive stance on future rate hikes.

This scenario provides a complex landscape for forex traders and investors, who must navigate through the interplay of inflation data and central bank policies. Observing these trends will be crucial for making informed decisions in the volatile forex market.

Comments are closed.