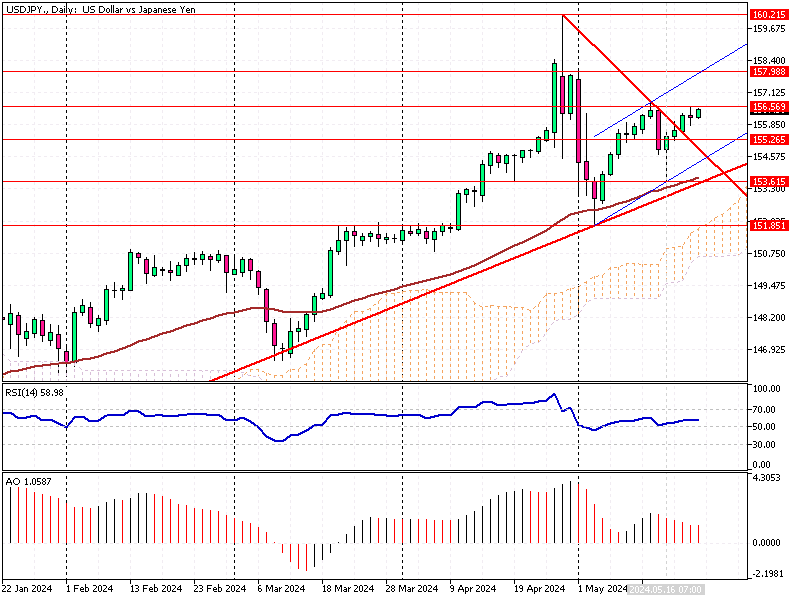

USDJPY – Japan Trade Deficit Widens

USDJPY Fundamental Analysis—The Japanese yen recently fell past 156 per dollar, marking a one-week low. A stronger US dollar drove this decline, as Federal Reserve officials have emphasized caution and the need for more confidence that inflation will return to 2% before considering interest rate cuts.

This stance by the Fed continues to highlight the stark difference in interest rates between the US and Japan, putting pressure on the yen.

Interest Rate Differentials and the Carry Trade

The significant interest rate gap between the US and Japan makes the carry trade attractive for traders. The carry trade involves borrowing funds in a low-interest-rate currency like the yen and investing in a higher-yielding currency like the dollar. This practice contributes to the yen’s weakness as investors seek higher returns elsewhere.

Government Intervention Concerns

Despite the yen’s depreciation, markets remain cautious about pushing the currency to new lows due to the risk of government intervention. Japanese Finance Minister Shunichi Suzuki has voiced concerns about the negative impact of a weak yen on wage hikes.

Such statements suggest that the government might step in if the yen continues to slide, adding an element of uncertainty for traders.

USDJPY – Japan Trade Deficit Widens

On the economic front, Japan’s trade deficit widened in April, signaling potential challenges for the country’s economy. However, there were some positive signs as well. Machinery orders unexpectedly increased in March, showing some resilience in specific sectors.

Additionally, business sentiment among large manufacturers remained steady in May, suggesting a stable outlook for significant companies.

What It Means for Forex Traders

For forex traders, these developments highlight the importance of staying informed about US and Japanese economic policies and data. The ongoing interest rate differentials suggest that the carry trade will continue influencing the yen. However, Japan’s potential for government intervention and mixed economic signals require careful monitoring.

In conclusion, while the yen’s recent decline can be attributed mainly to US monetary policy, traders must also consider Japan’s economic data and the possibility of government actions. Staying updated on these factors will be crucial for making informed trading decisions in the forex market.

Comments are closed.