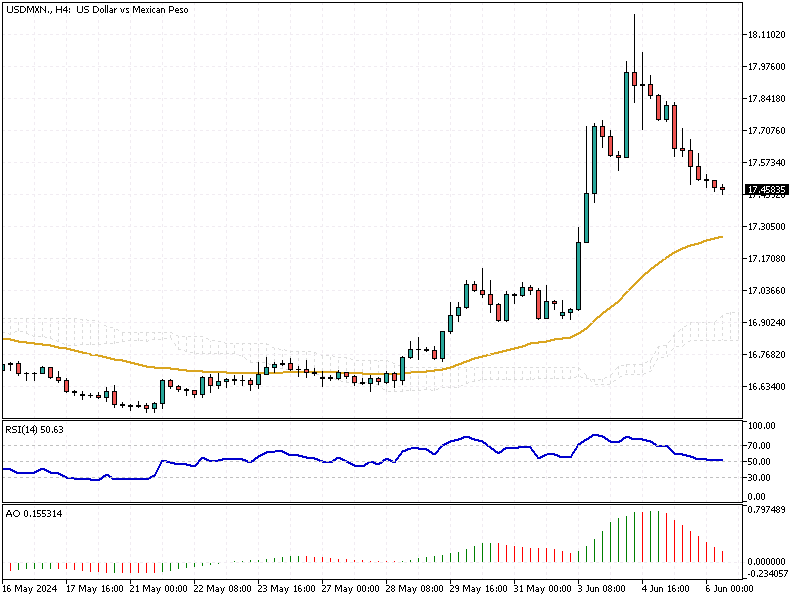

USDMXN Analysis – 6-June-2024

USD/MXN—The Mexican peso fell to nearly 18 per USD in June, marking its lowest point since October 2023. This significant drop occurred after preliminary results showed a decisive victory for the Moderna party and its allies in the Mexican Congress. The party’s success has increased state control over the economy, causing concern among investors.

Sheinbaum’s Landslide Victory Sparks Reform Fears

Claudia Sheinbaum of the Moderna party won the presidential election by a wide margin. While her win was expected, the party’s control over the upper and lower houses of Congress has raised fears about her ability to make constitutional changes and pursue controversial reforms.

Sheinbaum Policies Worry Markets

Investors worry that Sheinbaum may continue the policies of the current President, Lopez Obrador. These policies have been criticized for increasing the party’s influence over the judicial system, straining public finances, and relaxing efforts against drug cartels. These concerns have led to a sharp sell-off of the Mexican peso.

Policymakers Shift as Growth Slows

Adding to the economic uncertainty, disappointing first-quarter growth has led the Bank of Mexico to lower its annual economic growth forecasts. This situation has prompted a more cautious approach from policymakers, indicating a potential shift towards more supportive monetary policies.

Investors are now closely watching how these political and economic developments will unfold as they significantly impact Mexico’s financial stability and prospects.

Comments are closed.