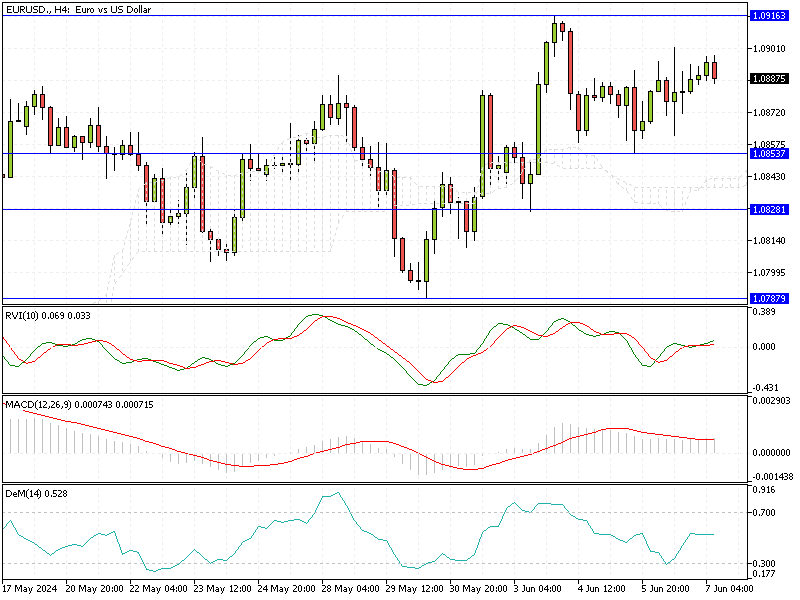

EURUSD Fundamental Analysis – 7-June-2024

EUR/USD—The euro recently experienced a modest increase, reaching $1.089, nearing its highest value in over two months. This comes after the European Central Bank (ECB) decided to lower key interest rates by 25 basis points, a move that was widely anticipated. However, the ECB also cautioned about future rate cuts, highlighting ongoing economic uncertainties.

ECB Vows to Maintain High Rates

In their announcement, ECB policymakers stressed that price pressures remain substantial. They projected that inflation would stay above their target level well into the following year. Consequently, the ECB committed to maintaining higher interest rates as long as needed to bring inflation back to its 2% target.

Lagarde Highlights ECB’s Data-Driven Approach

During a press conference following the rate decision, ECB President Christine Lagarde emphasized the bank’s data-driven approach. She clarified that the ECB is not locked into a specific path for future rate adjustments. Instead, the bank will closely monitor economic data and adjust its policies accordingly.

Summary

For consumers and investors, the ECB’s actions will be carefully calibrated to respond to evolving economic conditions. The ECB’s cautious stance aims to balance the need to control inflation with the need to support economic growth. Understanding these dynamics can help individuals make more informed financial decisions in the current economic landscape.

Comments are closed.