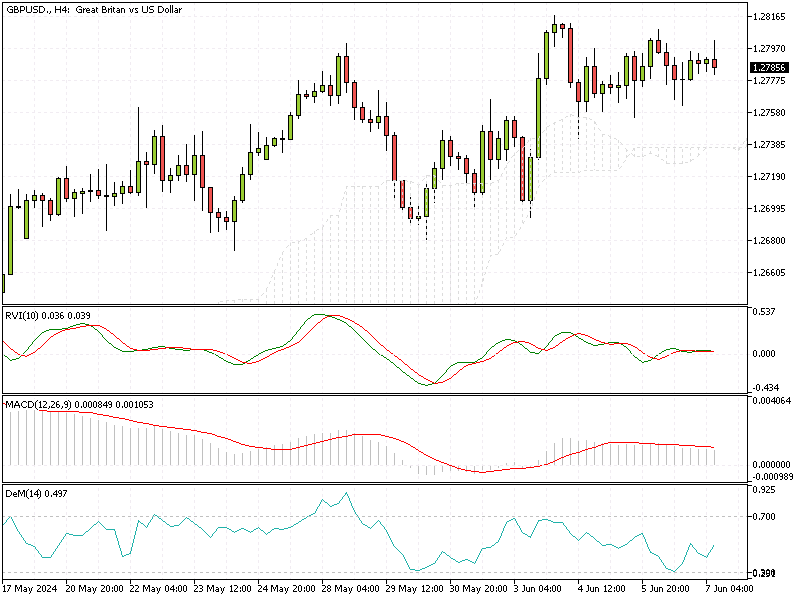

GBPUSD Fundamental Analysis – 7-June-2024

GBP/USD—The British pound remains strong, trading near $1.28 in the first week of June, a level not seen in three months. This follows a 2% rise in May as investors closely monitor central bank decisions. The European Central Bank (ECB) recently cut interest rates by 25 basis points, a move that was widely anticipated.

However, the ECB warned of ongoing inflationary pressures and raised inflation forecasts, suggesting that further rate cuts this year are unlikely.

BoE Holds Steady at 5.25% Rate

In contrast, the Bank of England (BoE) plans to keep interest rates steady at 5.25% in its upcoming June 20th meeting. This rate is the highest since 2008. While British inflation has shown signs of easing, it has not decreased as much as expected, leading to reduced expectations for multiple rate cuts by the BoE this year.

July Election Sparks Market Fears

With a general election scheduled for early July, the political landscape could add to the economic uncertainty. This uncertainty could influence market sentiments and economic decisions.

Summary

Understanding these dynamics is crucial for making informed financial decisions. In the coming months, central bank policies and political developments in the UK and Europe will likely continue to impact the strength of the British pound and broader economic conditions.

Comments are closed.